Just read this article at Fast Company, (Courtesy of David). Reading this at the same time as “The Spider and the Starfish” (which I am going to bore you all with over next few posts!!) lots of things come into focus.

In essence the FC article talks about how newspapers are having problems, when someone like Rob Curley can come along and dominate the local markets with localised internet sites for everything between restaurants to sports.

Which leaves them with one last problem: Once you’re online in a big way, what exactly do you do? Ten years in, most papers are still struggling to integrate digital and print journalism. “By and large, newspapers are in a panic,” says Jan Schaffer, the executive director at J-Lab: the Institute for Interactive Journalism at the University of Maryland at College Park. “They don’t have a clue what they should be doing with the Internet. They’re stuck in the old definition of news and how they cover it. There’s a need for drastic experimentation.

Source: Hyper-Local Hero

The article finishes with the usual panic picture for newspapers.

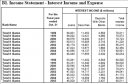

The News: Bad and Good

Total ad revenue 2005

Print | $47.4 billion (+1.5% since 2004)

Online | $2 billion (+31% since 2004)Blacker Than Ink

Percentage of newspapers reporting profitable Web sites

In 2002 | 62%

In 2005 | 95%Papers Thin

Daily newspaper circulation

In 1980 | 62.2 million (U.S. population = 237 million)

In 2005 | 54.6 million (U.S. population = 296 million)Number of daily papers

In 1980 | 1,745

In 2005 | 1,452

The articles focus is the newspapers panic, and how they are rushing to solve that panic. The natural assumption is that the newspapers merely have to get online, modify their business model, and everything will return to a new normal.

Switch to the book:

Lets go straight to principle #6 in the book:

- as industries become decentralised, overall profits decrease

The newspapers are looking at the $ 49.4million in ad revenue above, and trying to figure out how they can ensure they continue to get their share of that revenue.

Reality check!

What if the total ad revenue dropped from $49 million to $25 million? This is the basic question.

The book rightly points out that in the decentralised world of internet, profits don’t just shift from old channels to new ones – they disappear. It speaks about CraigsList that diverted enormous amounts of classified ads from paying newspaper ads to free internet ads. Revenue disappeared. Recall that classified were a mainstay of newspaper revenue.

To place this in context for banks, here are the long term results for the big 6 Canadian traditional Banks, whose information is nicely summarised at the Canadian Bankers Association.

Results 1998 to 2005 for the six big banks:

Loan growth: + 33%

Deposit growth: + 49%

Interest income growth: – 3%

Banks have survived by adding non interest revenue otherwise know as fees. These are tough numbers. Traditionally banks made money facilitating depositors and borrowers, yet that equation produced a drop in interest income over the seven year period.

Strategic question: what if non traditional competition can facilitate the deposit/ loan relationship without the fees?

Relevance to Bankwatch:

Banks can’t assume they can capture reduced profits that they attribute to squeezed margins and non-traditional competition, by being creative in creation of new fees, and alternative channels. A key component of survival will be elimination of core processes, and associated costs to compensate for reduced revenue.

Technorati tags: profitability, productivity, the+spider+and+the+starfish

Rob Curley was recently nominated to the Newspaper Association of America industry magazine’s 2006 list of the “20 under 40.” As a part of the online version of the “20 under 40″, Rob was asked to answer some additional questions (http://robcurley.com/2006/12/22/cutting-it-a-little-close/). I found a few of his comments interesting and very applicable to the banking industry, particularly “that we cannot be afraid of changes in our business model” and he goes on to talk about “reinventing dying revenue streams” and “different margins” then notes that “It seems like we spend so much time worrying and talking about the industry and the institution, when instead I think we should be talking about what our readers and advertisers want.” Banks should heed this advice and focus on what customers want and reinvent new ways to serve customers and connect with customers.