No need to get extreme just yet, but its interesting to reflect on previous bubble situations, and Japan is a good example. During the period 1986 – 1990 Japan experienced an extreme bubble based on stock and property values. Chatting with my wife, who lived through that bubble, there are distinct parallels. In other words they experienced North America 2000 plus 2007 yet simultaneously.

http://en.wikipedia.org/wiki/Japanese_asset_price_bubble

Prices were highest in Tokyo’s Ginza district in 1989, with choice properties fetching over US$1.5 million per square meter ($139,000 per square foot). Prices were only slightly less in other areas of Tokyo. By 2004, prime “A” property in Tokyo’s financial districts had slumped and Tokyo’s residential homes were a fraction of their peak, but still managed to be listed as the most expensive in the world. Trillions were wiped out with the combined collapse of the Tokyo stock and real estate markets.

…

The easily obtainable credit that had helped create and engorge the real estate bubble continued to be a problem for several years to come, and as late as 1997, banks were still making loans that had a low guarantee of being repaid. Loan Officers and Investment staff had a hard time finding anything to invest in that would return a profit.

…

Meanwhile, the extremely low interest rate offered for deposits, such as 0.1%, meant that ordinary Japanese savers were just as inclined to put their money under their beds as they were to put it in savings accounts.

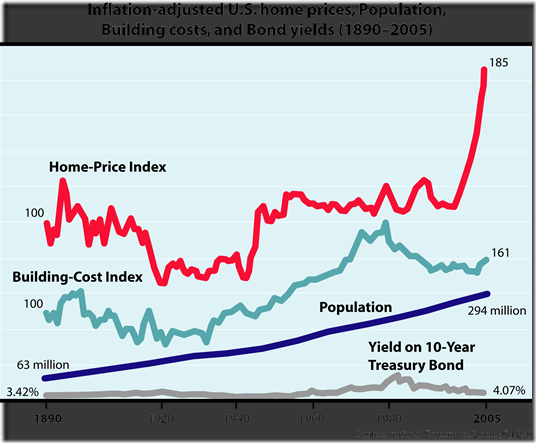

There are interesting lessons here, that point to possible scenarios for North America as it unwinds itself from the current situation. Economists will argue that the scenarios are different and that the outcomes will be different, yet we know some aspects are always true. The following chart from Wikipedia indicates the exponential increase in property prices lately. Common sense suggests this isn’t sustainable.

1890 1960 2005

BloggingStocks back in July commented on bubbles offerring five different types.

- Securitisation – If a bank sells a loan rather than keeping it on its books, it does not care whether the borrower pays back the loan. Now that the securitisation market is dead, banks can’t sell the loans they originate so they pay more attention to whether the borrower can repay.

- Leverage – During the boom, the typical investment bank and hedge fund had $1 of capital for every $32 in assets, meaning that it borrowed the other $31. This level of borrowing expands profits when the bubble is expanding and magnifies the losses during a contraction. If these financial institutions had more of a cushion of capital, they would not need to look to taxpayers to bail them out of their business mistakes.

- Fear of getting left behind – During an expansion, financial institutions look at their peers and they wonder why they are not doing as well.

- Young staff – When the bubble pops, financial institutions fire the people who made the loans and originated the deals. Many of the people they fire have the experience to understand what went right and what went wrong.

- Heads-I-win, tails-you-lose pay – As I have pointed out here and here, financial institutions pay people for the volume of business they bring in. This encourages them to close as many big deals as they can and to ignore the quality of those deals. When the deals go bad, nobody asks them to fork over their multi-million dollar bonuses to cover the losses of the deals they originated.

This is a terrific assessment. Securitisation is all about the sub-prime crisis, and the lack of transparency between the eventual lender and the original borrower. Leverage is why the Banks are unable to weather the subprime crisis without help. Points 3. 4. and 5. are pretty much how the Banks got into this situation in the first place.

Bottom Line … these are tough times, and everyone is an expert. The final result will undoubtedly be something that no-one anticipated, and we are just seeing the beginning today.