The annual World Economic Forum kicks off next week in Davos-Klosters, Switzerland, 28 January – 1 February 2009 with the headline “Shaping the Post-Crisis World”.

Obviously the financial world order is a topic, and this document sets out some scenario’s for disucssion at the forum. Mirror –> thefutureoftheglobalfinancialsystem1.

The question posed by the 88 page document is this “How might the governance and structure of the global financial system evolve over both the near-term and long-term?”

Its a fair question, and with the 2025 date its far enough out to get beyond the 2 week view that governments have adopted.

The joint chairmanship – note John Thain is part of it –

Throughout this process, intellectual stewardship and

guidance was provided by an actively involved Steering

Committee co-chaired by John Thain, President of Global

Banking, Securities and Wealth Management, Bank of

America Merrill Lynch, and David Rubenstein, Co-Founder

and Managing Director, The Carlyle Group.

Within the introduction, this caught my eye.

Back to basics in banking: Banks of all types

have begun the process of repairing their balance

sheets through higher liquidity and capital ratios,

coupled with reduced reliance on short-term

wholesale funding. Re-regulated banks are likely to

become more like utilities as they refocus on core

competencies. Moreover, bank strategies are less

likely to overlap as individual competitive advantages

are reaffirmed.

The concept of banking as a utility keeps popping up – this is a reflection of banking as an ‘essential service’ that we can take for granted, just like running water and electricity. This has enormous implications for innovation – hard to imagine innovation down at the local gas-works when your job is solely to ensure supply meets demand – but I digress.

The four scenarios are described thus:

- Financial regionalism is a world in which post-crisis

blame-shifting and the threat of further economic

contagion create three major blocs on trade and financial

policy, forcing global companies to construct tripartite

strategies to operate globally.- Re-engineered Western-centrism is a highly

coordinated and financially homogenous world that has yet

to face up to the realities of shifting power and the dangers

of regulating for the last crisis rather than the next.- Fragmented protectionism is a world characterized

by division, conflict, currency controls and a race-to-the

bottom dynamic that only serves to deepen the long-term

effects of the financial crisis.- Rebalanced multilateralism is a world in which initial

barriers to coordination and disagreement over effective risk

management approaches are overcome in the context of

rapidly shifting geo-economic power.

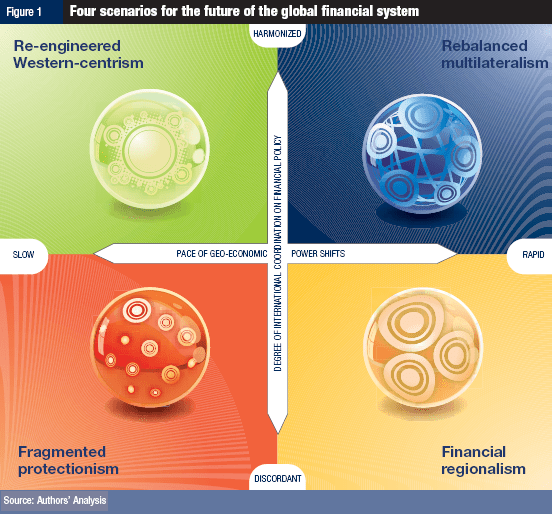

Graphically they are shown here:

Based on this view I would lean towards most likely scenario’s being on the right, ie the rapid side. This would leave us with regionalism to multilaterism, and that is the sense of conflict we feel today – protectionism or globalism.

The quick view is that debt has increased significantly in the last 20 years in the US, and that has the concomitant effect on the world as the largest economy. In particular the debt increase is personal, and financial services.

The unwinding of consumer debt, particularly among US

households, will have the longest and most enduring

effect. Despite the various fiscal stimulus packages

currently making their way through the major economies,

consumption across industrialized countries is all but

certain to give way to increased private savings (Figure 7).

Deleveraging and increased government intervention are the key over-riding impacts. They conclude the primary impacts will be felt as follows:

- Interventionist regulatory framework: Increased

global regulatory coordination and expanded financial

regulation and oversight will likely curtail the growth of

many in the financial industry.- Back to basics in banking: The convergence

between banking strategies will reverse, as survivors

increasingly reorient their business models around

client needs and reassessed core competencies.- Restructuring in alternatives: Challenging conditions

will result in structural changes in the hedge fund

industry, reassessed strategies within private equity,

and the emergence of new actors, such as low cost

indexation providers and “unconstrained” owners of

capital.- A tale of two insurers: While some insurers will be

forced to focus on survival, many will be able to

capitalize on the emergence of new acquisition

opportunities and continuing strength in their

underlying business.

Relevance to Bankwatch:

Of interest to this me and this blog is #2. With that premise, and banks as heavily regulated utilities, what of innovation, and where will it be allowed to arise in financial services – who will [be allowed to] push the envelope?

As always thoughts welcomed.

I think that banking as a utility could be actually be a strong foundation for innovation if it provides a clearer separation between risk borne by government and by private parties.

In a model where we fund long-term assets with short-term liabilities in the limits allowed by institutions, we are in constant risks of bubble and crashes, more importantly profits are inherently privatized and losses socialized. Over-regulating this model won’t make it a utility.

The only way to make banking a utility you can take for granted is to make sure that assets and liabilities risks/terms are fully aligned. Deposits should be backed by short-term highly-liquid assets. Long-term risky loans backed by long-term investments known to be risky by investors.

As far as innovation is concerned, I think a lot of excessive liquidity allocation innovation can be built on top of this infrastructure.

The key question in such system is whether and how states will keep their privilege to control the economy as well as get huge loans of cash quickly (it’s historically been easier to finance a war by getting a loan from a bank than by getting a loan from or taxing citizens).