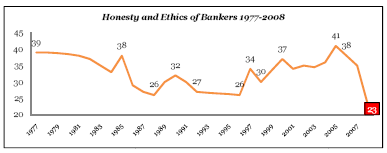

Reflecting on the theme of bankers reputation “being shot” that is being picked up at Davos, Gallup have releases some data based on their Gallup/ USA Today poll that addresses the reputation of bankers. Next time Citi decide to buy a jet they should take a look at this data first, and consider the moral and reputation implications. Nothwithstanding this is a poll, the trend over time, and the trend in the last year is clear. HT Douglas Berlon.

The drop in 2008 is from 38 to 23 which represents the lowest in this dataset since 1977. Of course there is the debate about investment bankers and regular bankers being painted with the same brush, but that argument fails because banks chose to make that association when it suited.

Here is the data ….

I’m not trying to defend anyone’s ethics during this mess, but I have to take issue with the Gallup/USAToday graph. Misleading graphs are a pet peeve of mine. Fix your Y axis, kids. A drop of 18 points over 4 years looks plenty bad…no need to graphically suggest that 23 ~ 0.

@dan: Right on! Please see my article entitled “Honesty and Ethics of Market Researchers: Time for Introspection”

@kids – of course thats the oldest trick in the books, yet the fact remains that its at the lowest point since the ’70’s. I think we have to agree there is an issue here.

@Colin: I don’t argue that there’s an issue here. But I’m not sure that the “issue” is any worse than it’s ever been.

What’s different now is the level of attention it’s getting. With a proliferation 24-hour news channels, sites, combined with the gazillions of business/political bloggers who just HAVE TO weigh in with their opinion (or worse, weigh in nothing but links to the other bloggers’ opinions. With all this attention, the public perceives it to be a bigger problem than in the past.

You tell me: What are the FIs doing differently now?

@ron – you raise an important point. Despite similar polling methods annually (which I question too) the environmental circumstances that surround people and how they get information is dramatically different. It is probably also true that the same trend exists for many other corporate sectors, suggesting a more systemic shift.

Nonetheless a banker would be insane to ignore these results. A closed mind will not solve for the future.