I am an unabashed avid follower of Online Banking Report, and the latest “Online & Mobile Banking Forecast” continues the classic of Jims annual output.

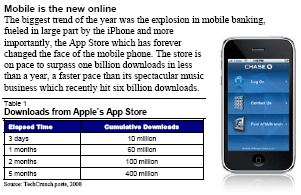

The focus of online banking and mobile is one key attribute of this years focus. In fact having the iphone on the front page is illustrative of the outside the box thinking.

This year in particular is when all Banks ought be thinking of ways to innovate and get outside the box.

Clearly it is no longer business as usual, and will not be for some time.

Gathering deposits is essential to future success, but that will come one customer at a time – the classic conundrum of acquisition cost remains if banks choose to use old ways to acquire.

A key component of customer acquisition is customer retention, and the thrity six pages here are one way to structure your plans to retain the customers you have. Bank of America and Wells Fargo are doing that – what about your bank? As word gets out, such innovations will drive acquisition too.

Report summary:

The report follows the usual style with first a summary of innovation to date. What makes this intersting is that enough years and innovations have gone by that the history lesson in itself is fascinating, and awe inspiring if one thinks of the things that your bank did not implement. The sheer volume of facts in Jims reports are worth the price – no-where else is this level of detail available in one place.

Then there is a review of 2008 innovations and here it hits close to home for banks. In the top innovations for 2008, there are only four banks mentioned (Wells Fargo, Bank of America, PNC and Zion). Thats four out of eight thousand eligible! For the top ten in 2008 there is one bank makes it.

The breadth and depth of the innovations covered is quite astounding, and to see them laid out in one place is refreshing showing that the possibility to innovate is there for the taking.

Finally there are the honourable mentions of 2008. This is a fact filled detailed view of the current state of online and mobile and this one in particular frankly ought to be required reading for every banker. Well done Jim and the team.