London UK: Prices and sales have fallen in the London financial district and bankers and lawyers are staying away (FT)

Ontario Canada; More first-time home buyers and minorities have also been looking to the suburbs for affordability, he added. (Real Estate Monitor)

— —

Something is happening to urban environments. I can see it with my own eyes as someone who lives in a downtown driven by Financial Services.

Recent press is beginning to observe a significant shift to suburban homes. Here are some thoughts, observations and questions.

A typical food court downtown would have 25 – 40 storefronts. The current average is about 5 storefronts and even those are part of larger conglomerates. The small independents are gone.

Out on Yonge, King and other usually busy downtown streets and while the most recent rules for restaurants and pubs permit on premise customers, there are few customers.

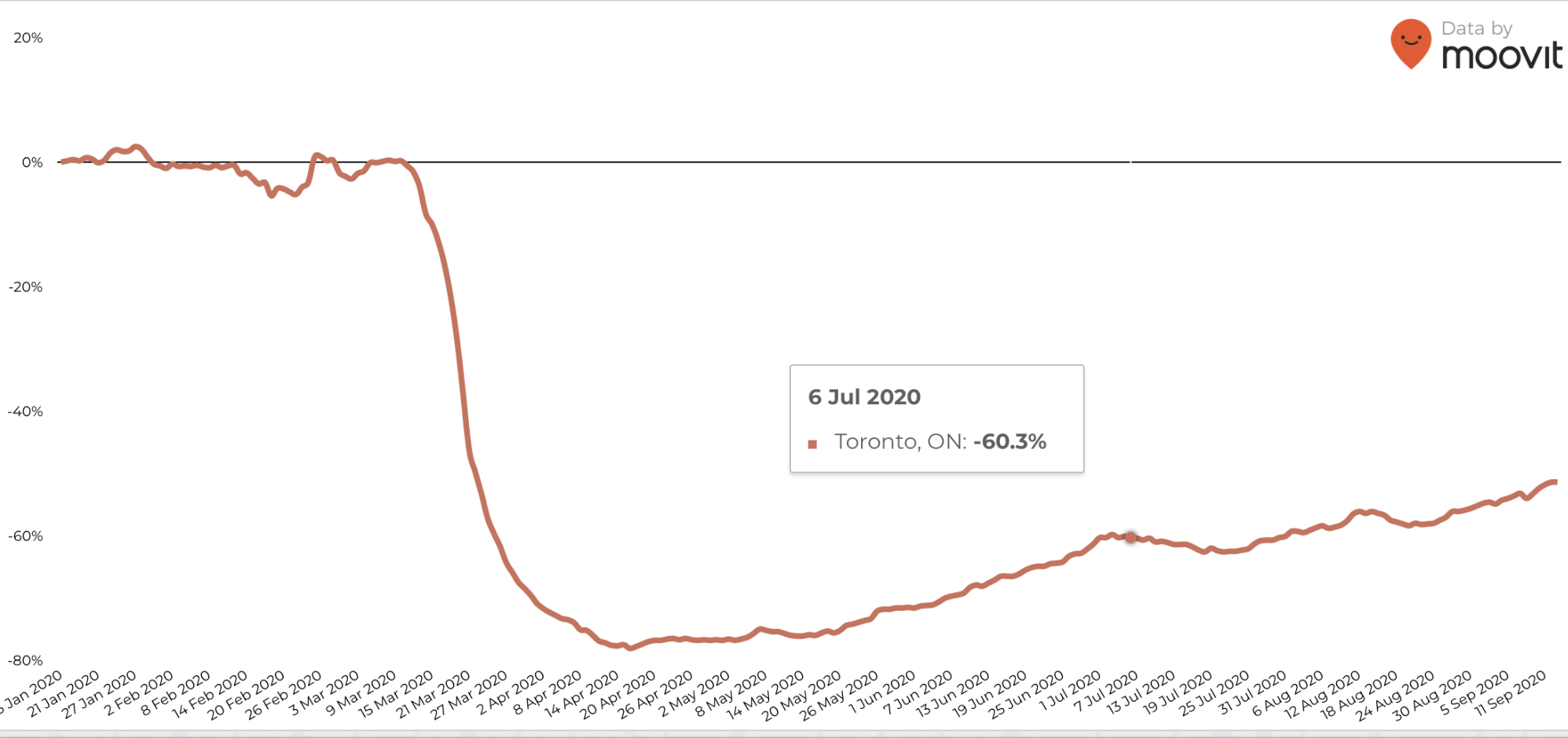

I have not been on the subway since pre March but reports indicate low ridership of 60% with a gradual increase evident.

At face value the shift is driven by:

- millennials have built home equity

- millennials are moving to family mode and the associated trappings of a large home, garden and all that comes with it

- work from home is now semi permanent with most banks indicating 2021 as the earliest for any change in that approach given maintenance of productivity and potential for future real estate cost reduction

- significant increase in rental vacancy rates from 1% to 7% + in July 2020 as younger renters move away from downtown

Landlords

Commercial landlords have a great deal to lose. At a minimum the rental /location profile could display dramatics change as tenants adapt to the new normal, and this in turn would drive changes to rent that could be sustained depending upon vacancy rates, retail business volumes and retail profitability.

These factors would all accumulate to provide for a supportable profile of rents that commercial landlords can charge.

Challenges and open questions

- in the absence of financial services, who would purchase or rent the office towers

- what discounts could landlords afford to offer financial services rather than see buildings go vacant

- financial services are locked into leases that will constrain their actions but this could be adjustments to the pace of change rather than curtailment of the change

- are we in fact seeing a blip in activity and shifts

- changes driven by generational shifts tend to be permanent and this would suggest a return to 100% of pre-pandemic is highly unlikely

Headwinds to full return for urban to pre pandemic levels

The generational shifts evident with millennials could well be the defining shift, with the pandemic accelerating that shift.

The outlier is the strategic direction from Banks. Toronto like many downtowns in 2019 was driven by Financial services. Were those financial services companies decide to approach resourcing and logistics differently with a permanent shift from or back to urban this would change everything.

All in all it seems clear a return to100% of pre-pandemic is unlikely. Thus a negative economic impact can be expected and banks can expect some difficult planning decisions.