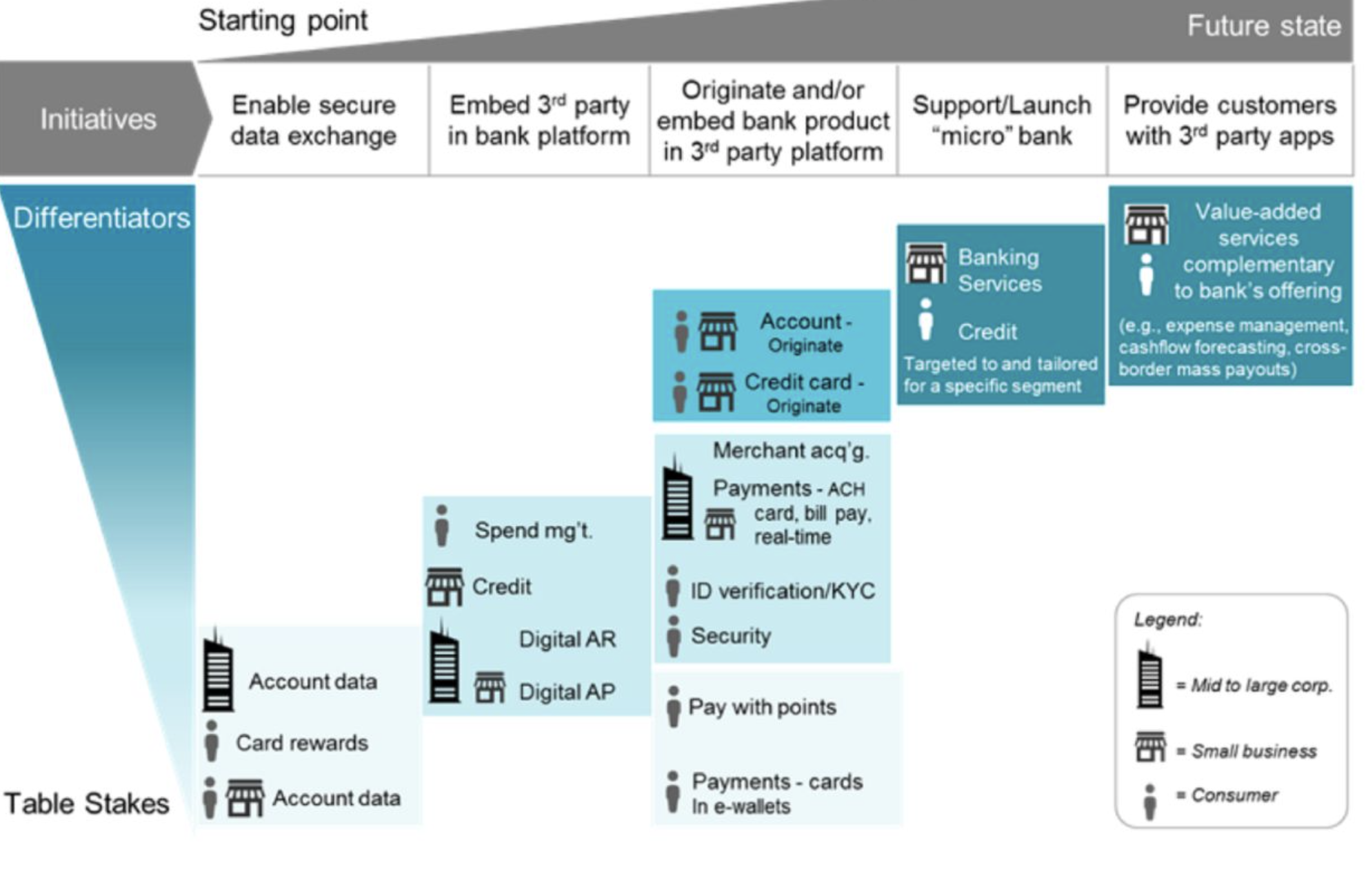

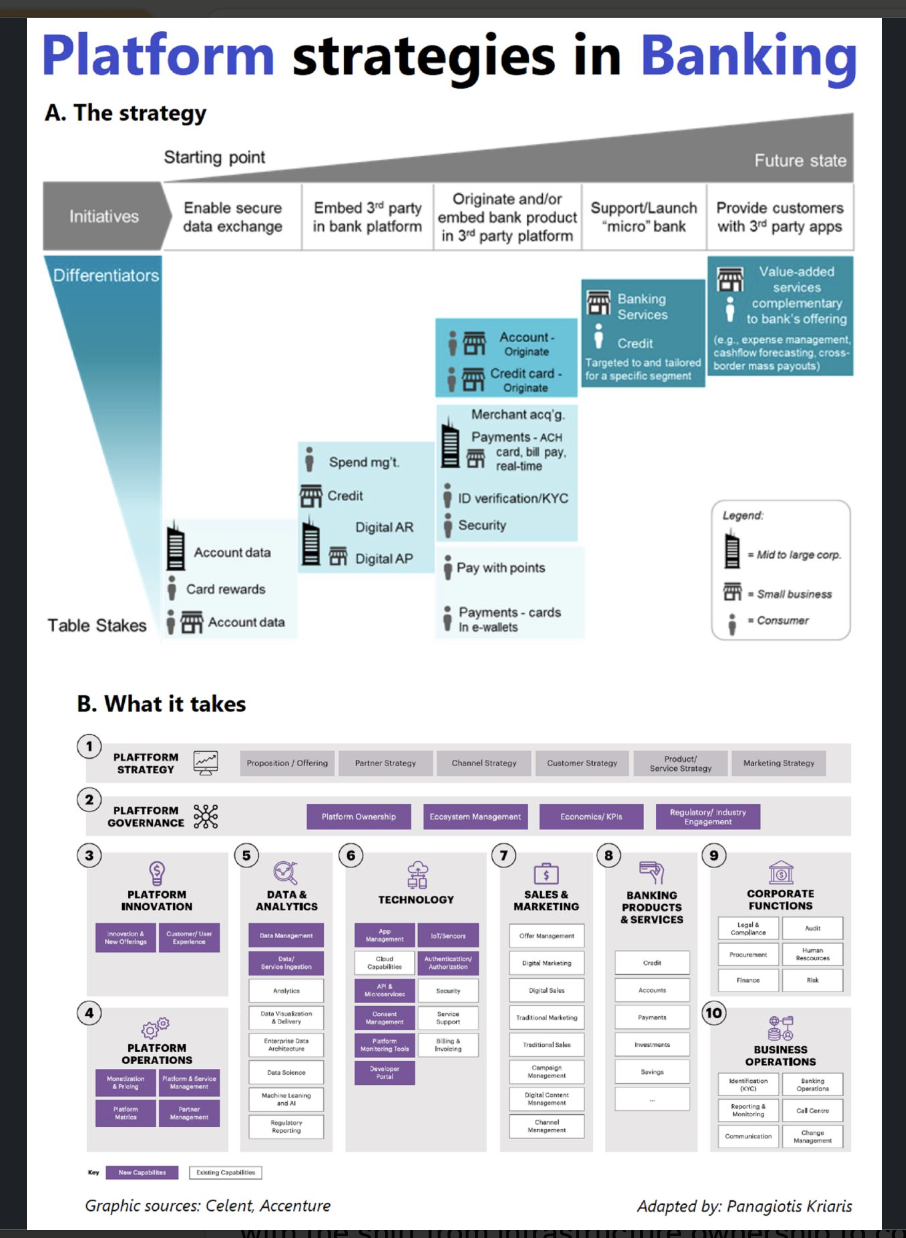

Kriasis produces many views digital on LinkedIn. This one caught my attention taking what he describes as a platform view. What caught my attention is that it frames a conversation on the topic and moving items around still works in the bigger picture when thinking about one bank.

Extract from full pic below

Use of the platform view works because it fits with network effects, partnering, integrators, cloud providers, customers and how they all fit with other partners’ platforms.

The third column is the main target for most banks with end to end origination. One piece that needs adding here is the not so small detail of Straight Through Processing (STP). It is one thing talk of Origination, and to the new customer it may seem somewhat transparent but if there are hosts of employees working an internal process application to achieve full customer set up this means a lot of inefficiency built in.

STP refers to customer applications for accounts or lending products seamlessly navigating KYC, AML, credit processing, data retention automatically. I compare this to one bank I know of where a simple forex transfer is handled online but takes three days because of employee involvement to complete the transaction.

STP or Straight Through Processing has to be the target state which introduces technology design, architecture and integration into play.

Anyhow thank you Kriasis for the diagram.

Courtesy of Panagiotis Kriasis on LinkedIn