As I mentioned in last post, I have been drilling down on a few themes that look at potential root cause for the bank failures of banks this week:

Introduction

- Here are the bank failures as of Mar 17th that I am aware of

- SVB

- Signature

- Credit Suisse

- First Republic

- Silvergate

- Failures have been all American but with offices in Canada, UK and Japan for now.

- The government response has largely been focussed on solving each failure with a refusal to acknowledge system risk to banking.

JP Morgan have featured in US solutions, HSB in Britain and UBS in Switzerland. - The response has been generally focussed on combinations of funding, seeking purchasers and supplemented by firing management.

What is the root cause of banking failures?

It seems too simple to only refund these banks and introduce new management. That does not address any systemic risk although it is consistent with Central Bank belief that no systemic risk exists.

Central Bankers are reluctant to acknowledge systemic risk so let’s look at some areas and examples for potential risks as noted in press based on market participant quotes supplemented by my own views.

1. Blinders to risk

These comments as reported by Bloomberg from First Republic and Piper Sandler are so missing the point when talking about headwinds to future profit:

In a statement after the official close of US exchanges, First Republic said its borrowings from the Fed varied from $20 billion to $109 billion from March 10 to March 15. The bank said it had a cash position of approximately $34 billion on March 15; it had reported $70 billion of unused liquidity on March 12.

“With the new funds being added at market rates, we expect earnings will be revised notably downward for the coming quarters,” Andrew Liesch, an analyst at Piper Sandler who holds a neutral rating on First Republic, wrote in a note

AND

Jamie Dimon and Janet Yellen were on a call Tuesday, when she floated an idea: What if the nation’s largest lenders deposited billions of dollars into First Republic Bank, the latest firm getting nudged toward the brink by a depositor panic.

Dimon was game — and soon the chief executive officer of JPMorgan Chase & Co. was reaching out to the heads of the next three largest US lenders: Bank of America Corp., Citigroup Inc. and Wells Fargo & Co.

2. Misunderstanding risk

RBC BlueBay Asset Management suggests “this time is different” than the 2008 crisis cause it was a mortgage problem.

His views were shared by Mark Dowding, chief investment officer at RBC BlueBay Asset Management, who said that while the crises at SVB and Credit Suisse may rekindle memories of the 2008 banking crash things are different this time around.

banks were much less regulated, ran excessive leverage and were poorly capitalized,” he said. “Moreover, it was credit impairment in US mortgages which acted as a catalyst that then triggered a collapse. In 2023, the banking landscape is totally different.”

I would suggest that the problem is in fact identical. The Great Financial Crisis (GFC yes it apparently has an acronym now) was rooted in credit impairment but that is nothing more than an unexpected shift in value.

When calls were made on banks in 2023 and they were forced to liquidate Government Bands the value was not there because face value is only available at maturity not during margin calls which see a discount.

3. Carry Trade

And so to the issue raised by Gillian Test below.

Traditional Banking Operation

Banks operate on the principle of funds matching., or at least well run Banks do.

At the lowest level Banks attract deposit instruments such as Guaranteed Investment Certificates (Canada) which have locked in rates particular to each instrument. The depositor understands this and the bank must use the funds, and apply contains in ways that reflect the conditions. The customer who purchases the GIC must hold it to maturity to benefit from the full interest rate.

The bank lends out the deposited funds typically as mortgages supported by qualified collateral (property).

I recall in my branch days fielding customer requests to cash in a GIC. We were required to seek Head Office approval which was not guaranteed, and the underlying reason is to maintain the funds matching principle.

The argument against this apparently simplistic view does not alter the principle. During the GFC contributor to the root cause was bundled mortgages of various quality and designating unrealistic ratings. Those bundled mortgages were sold to investors and failed to understand the underlying risk. This all came to a calamitous head Sep 18th, 2008.

Carry Trade banking

One way to think about this is banks trading for their own account. Funds far greater than balance sheet customer deposits are bought, bundled and sold. This activity calls into play the banks capital base and its ability to cover losses which of course are not expected.

The dollar value is gigantic and has the additional quirk of FX risk in many cases. When we consider the growth of money supply over last 20 years alone the volumes outweigh the requirement and the resultant cash flush has to go somewhere, hence carry trade.

The world is so flush with cash that banks, hedge funds and the murky world of shadow banking aggregate deposits, rebundle and resell either within local markets or intra country.

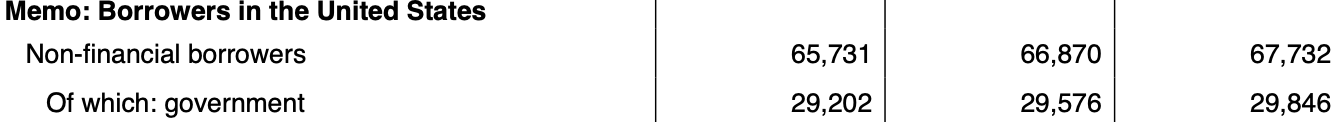

Here is a snapshot from Bank of International Settlements of US Carry trade from 2022 measured in biillions.

And derivatives which totalled $640Bn during the last crisis:

These activities are largely opaque because banks that are Too big to Fail are primary players in the activity. But are they? Sure bundling is involved withe good old spreadsheets. The upshot is that we are back to network effect risk which is of such scale few want to acknowledge that risk exists.

I found a Product page for SVB advertising to customers. Customers were offered an SVB account supported by behind the scenes money market dealers. Is that risk understood by regulators. This is a novel product snd goes a long way to understanding why SVB was popular.

This would be an entire analysis and I will stop there. But in short there are risks related to funding within innocuous deposits.

SVB crisis Solution from US Fed

This is itself a risk because it introduces a new moral hazard.

The Federal Reserve as lender of last resort created BTFP as a last resort lender to the lender of last resort – huh? You can’t make this stuff up unless of course you do it under air cover of panic during a crisis. Today on Bloomberg they were reporting $160Bn in calls at the Fed discount window; an unheard of amount ? Might the BTFP be an effort to smoke and mirrors one has to ask.

- On March 12, Federal Reserve created the Bank Term Funding Program (BTFP), an emergency lending program providing loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions that pledge U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Wikipedia

- The program offers loans of up to one year to eligible borrowers who pledge as collateral certain types of securities including U.S. Treasuries, agency debt, and mortgage-backed securities

- Ed Note what are the risks of this collateral being valueless given the expected calls on the collateral and the low likelihood they will be held to maturity due to pre maturity calls.

- Ed Note what are the risks of this collateral being valueless given the expected calls on the collateral and the low likelihood they will be held to maturity due to pre maturity calls.

Sundry other avenues to analyse from NYT

NYT reported earlier this week

The Downfall of Silicon Valley Bank

One of the most prominent lenders in the world of technology start-ups collapsed on March 10, forcing the U.S. government to step in.

- A Rapid Fall: Struggling under the weight of ill-fated decisions and panicked customers, Silicon Valley Bank became the biggest U.S. bank to fail since the 2008 financial crisis. Here is how its collapse unfolded.

- The Fallout: The bank’s implosion rattled a start-up industry already on edge, and some of the worst casualties of the collapse were companies developing solutions for the climate crisis.

- Ambition and Management Mistakes: While Gregory Becker, the chief executive of Silicon Valley Bank, extolled tech innovation, the institution was caught flat-footed by economic change.

- A Reckoning for Silicon Valley: Even as the government assured that depositors would be able to recover their money from Silicon Valley Bank, the episode exposed the tech industry’s vulnerabilities.

- Federal Inquiry: The Justice Department is said to have opened an investigation into Silicon Valley Bank’s collapse. Legal experts said that the focus could be insider sales by several bank executives in the weeks before the failure.

CONCLUSION

The sheer volume of money and the impacts of re-bundling create new risk which transport across banks and countries.

Even at the Central Bank level I wonder about gaps in understanding the bigger picture.

END

—

My earlier warm up post in summary form. Click through for full post.

SVB exposes a significant carry trade problem

Gillian Twrites an excellent piece that adds colour to the root cause discussion on SVB.

The first is that the events around SVB were akin to the blowing up of a gigantic “carry trade”. This is the phrase that financial traders invoke when they borrow cheaply in one asset (say, a currency or short-term bond) to invest in a higher-yielding one (such as a different currency or longer duration instrument).

Bankers rarely describe themselves as rabid carry traders — they prefer to think that banks perform carefully controlled maturity transformations (that is, turning deposits into loans) for their clients, with asset-liability management.