This post is intended to discuss root causes of the funds shift to Money Market Funds and the impact on the banking system risk.

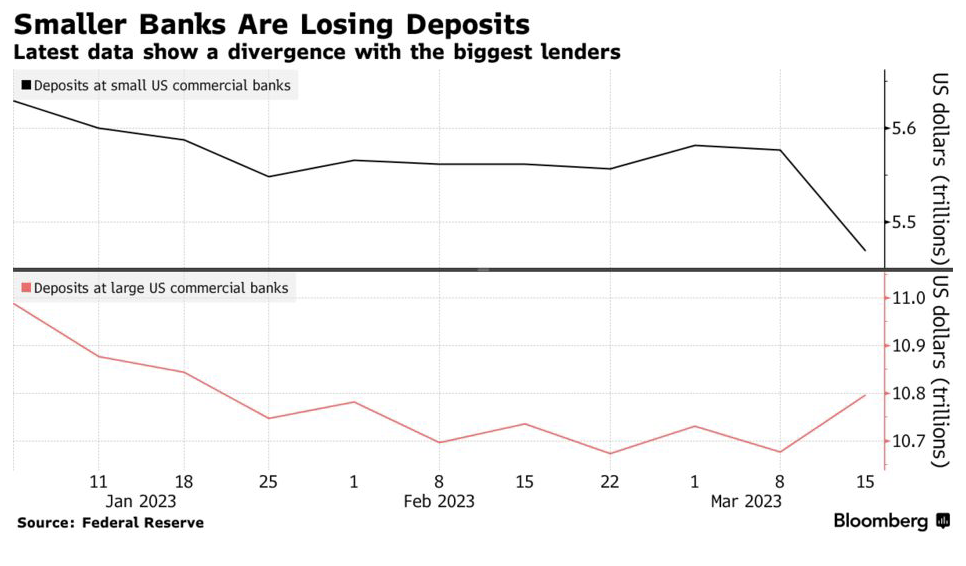

The storyline here is following the SVB and Banking cries began, there is reduced faith in smaller Banks for deposits and better rates available in Money Market Funds.

Money Markey funds offered by large institutions and are offsetting the drop in deposits sitting with smaller banks.

This is a systemic shift driven by risk appetite and rates offered. But it leaves open the question of how Money Market Funds (MMF) are investing their money to generate those higher interest rates.

The answer is simple; MMF are investing in the same types of Government and Corporate issued bonds that likes of SVB was pre February crash.

Bond yields and bond prices move in lockstep against each other. As rates rise bond prices drop. This was the liquidity trap SVP management missed. So when so many depositors tried to withdraw their deposits the drop in bond prices resulted in an immediate mark to market re-evaluation of SVB investments using customer deposits and had insufficient capital or cash to satisfy the customer withdrawals. We had a bank run.

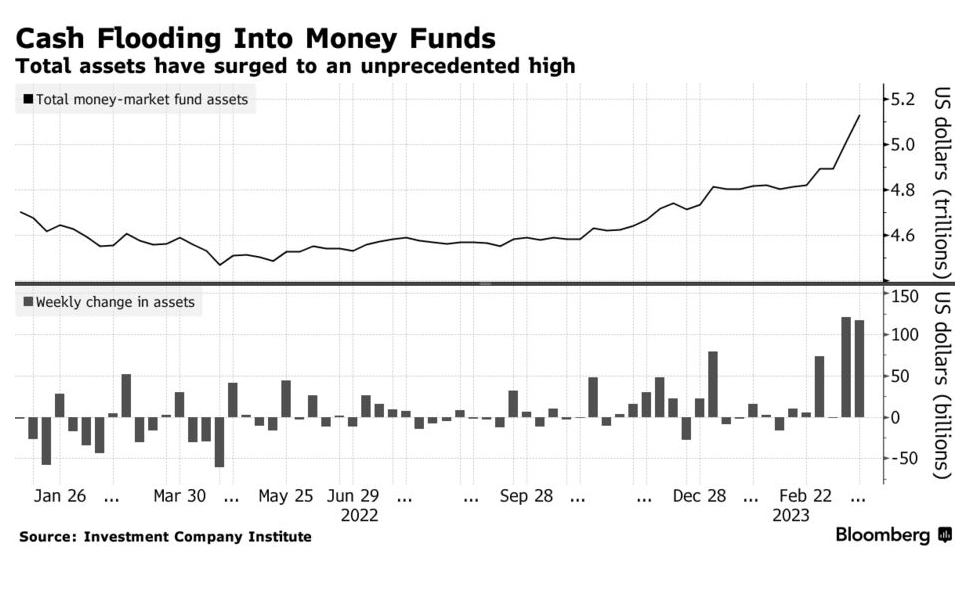

So the deposits have moved to MMF over last few months which was a desired outcome of the Fed. That trend went into overdrive post SVB and no there is $5 trillion in MMF. That is $5 trillion which is not invested in stocks. For reference NYSE is value at US $ 25 trillion +/-. The MMF are a consequential percentage thereof.

Of course, a certain amount of that is what the Fed is actually trying to engineer as it uses tighter monetary policy to combat inflation. But a sudden rush of cash out of the banking system — in excess of what’s already been witnessed — risks increasing the odds that a so-called soft landing might morph into a deep recession.

And this risk identified for MMF which we can see is precisely the same Price risk that hit SVB.

Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them

CONCLUSION

Bankers understand risk.

There is an interest rate risk associated with MMF. If rates rise the bond prices will drop and that same price risk will appear. There is one mitigating circumstance which is not lost on the Fed; the institutions offering MMF are very large and better able to withstand interest rate headwinds.

Risk is a complicated things. While managing interest rate headwinds may be more manageable now there are numerous other risks beginning with credit quality of the underlying bond issuers for one.

As noted by Bloomberg risks exist, “increasing the odds that a so-called soft landing might morph into a deep recession”.

— — — —

NOTE: WHAT FOLLOWS IS FOR PARTIAL EDUCATION AND INFORMATION ONLY.

—

Courtesy of FIDELITY LEARNING CENTER

DO NOT RELY ON ANY COMMENTS HERE FOR INVESTMENT PURPOSES. THIS IS SOLELY FOR INFORMATION TO UNDERSTAND MONEY MARKET FUNDS ONLY.

What are money market funds?

Money market funds are fixed income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk.

Regulations from the U.S. Securities and Exchange Commission (SEC) define 3 categories of money market funds based on investments of the fund—government, prime, and municipal.

Types of money market funds

Investments can include short-term U.S. Treasury securities, federal agency notes, Eurodollar deposits, repurchase agreements, certificates of deposit, corporate commercial paper, and obligations of states, cities, or other types of municipal agencies—depending on the focus of the fund.

Risks of money market funds

- Credit risk

Unlike typical bank certificates of deposit (CDs) or savings accounts, money market mutual funds are not insured by the Federal Deposit Insurance Corporation (FDIC); although money market mutual funds invest in high-quality securities and seek to preserve the value of your investment, there is the risk that you could lose money, and there is no guarantee that you will receive $1 per share when you redeem your shares - Inflation risk

Because of the safety and short-term nature of the underlying investments, money market mutual fund returns tend to be lower than those of more volatile investments such as typical stock and bond mutual funds, creating the risk that the rate of return may not keep pace with inflation - Price risk

Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them.

Advantages of money market funds

- Stability

Money market mutual funds are considered to be one of the least volatile types of mutual fund investments - Liquidity

It’s easy to settle your brokerage account trades in other investments, or retrieve funds from a money market mutual fund—generally assets are available by the next business day - Security

The funds are required by federal regulations to invest in short-maturity, low-risk investments, making them less prone to market fluctuations than many other types of investments - Short duration

Because the duration of money market mutual funds is so short—at maximum a few months—they are typically subject to less interest rate risk than longer-maturing bond fund investments - Diversification

Money market mutual funds tend to hold many different securities, with limited exposure outside U.S. Treasury funds to any single issuer - Potential tax advantages

Some money market funds invest in securities whose interest payments are typically exempt from federal, and in some cases, state income taxes; these funds can be a potential source of stable, tax-efficient income