The NIRA provides an overview of money laundering and terrorist financing risks posed to various business types and sectors before the application of mitigation measures.

Its also the first AML/ATF Regime Strategy published by Canada and demonstrates the importance of public accountability and transparency to the success of the Regime.

The report contains priorities grouped under the following four themes:

- Increasing operational effectiveness;

- Addressing legislative and regulatory gaps;

- Improving Regime governance and coordination; and

- Contributing to international community efforts to combat money laundering and terrorist financing.

Thank you Josep Dixon FINTRAC for the notification of the release- LinkedIn

Executive Summary per GoC

Money laundering and terrorist financing compromise the integrity of the financial system and are a threat to global safety and security. The Government of Canada takes these issues very seriously and continually works to enhance its anti-money laundering and anti-terrorist financing (AML/ATF) Regime (the Regime) in response to emerging money laundering and terrorist financing risks.

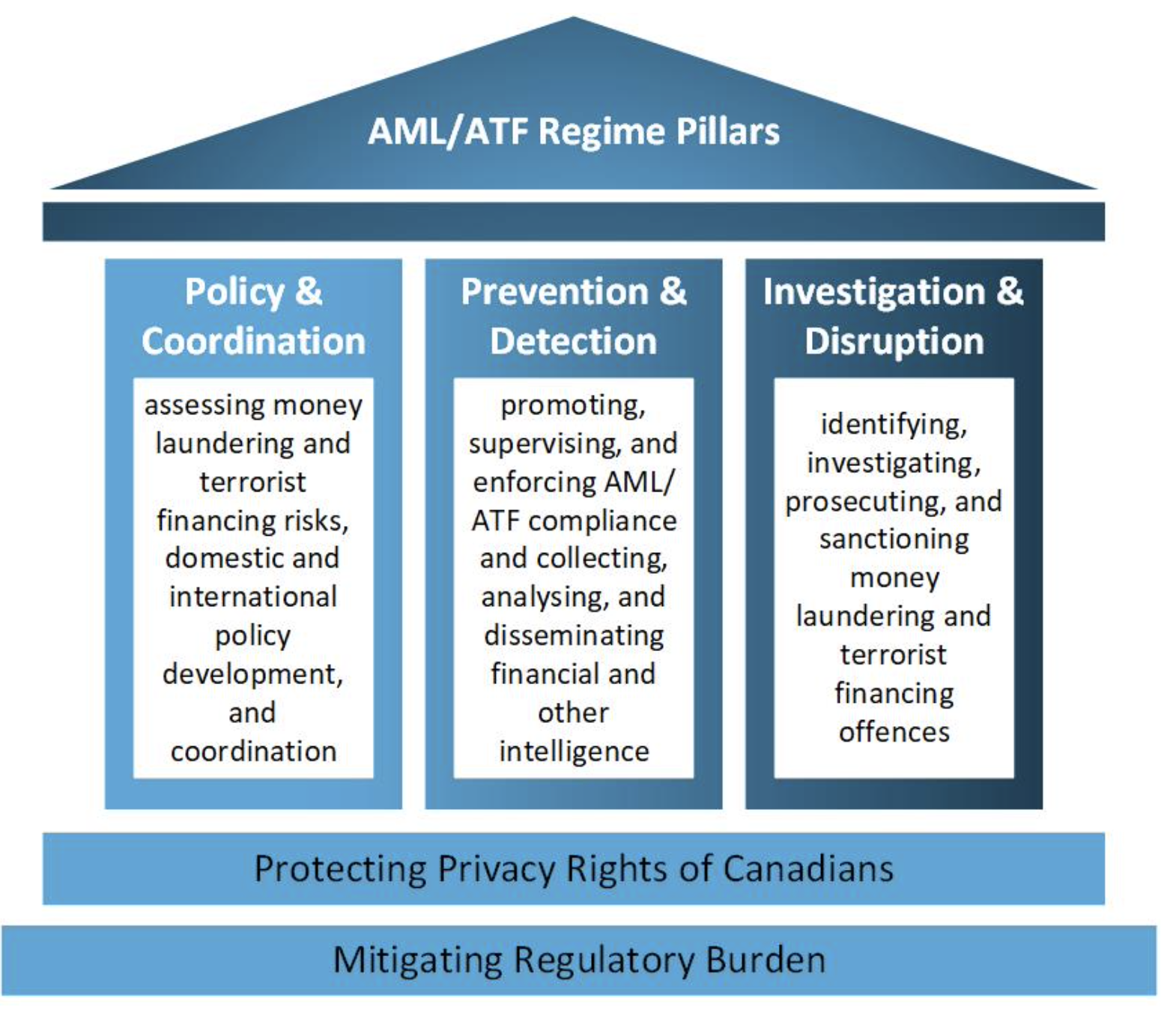

Canada’s AML/ATF framework consists of a robust and comprehensive set of legislative statutes that set out the responsibilities of Regime partners and that seek to combat money laundering and terrorist financing while respecting the constitutional division of powers, the Canadian Charter of Rights and Freedoms, and the privacy rights of Canadians.

Combatting money laundering and terrorist financing is a collaborative effort, requiring coordination across all orders of government, public and private sectors, and international borders. The Regime is operated by 13 federal departments and agencies, each with their own respective mandates and areas of responsibilities, coordinated by the Department of Finance Canada. Provincial and municipal law enforcement agencies, as well as provincial and territorial regulators, are also involved in combatting these illicit activities.

Within the private sector, more than 24,000 Canadian businesses play a critical frontline role in efforts to prevent and detect money laundering and terrorist financing, by complying with obligations set out in the Proceeds of Crime (Money Laundering) and Terrorist Finance Act (PCMLTFA). Many of these businesses take extra steps to combat money laundering and its associated predicate crimes by collaborating closely with key Regime partners in the form of public-private partnerships.

At the international level, the Government of Canada works with a strong network of international organizations and key allies to effectively address complex and evolving security threats involving money laundering and terrorist financing. This includes working with the Financial Action Task Force (FATF), FATF-Style Regional Bodies (FSRBs), the Egmont Group of Financial Intelligence Units (FIUs), Five Eye Partners (United States, United Kingdom, New Zealand and Australia), and other international bodies to identify emerging trends, share information, and develop international best practices to combat money laundering and terrorist financing.

To remain effective, the Regime must continually adapt to changes in its operating environment. For instance, a significant trend towards financial sector digitalization accelerated by the COVID-19 pandemic has changed the way people interact with the financial sector – providing opportunities for Canadians, but also challenging existing approaches to regulation and law enforcement. This includes the growing use of virtual currencies and other financial technologies that facilitate international transfer of value, often with enhanced anonymity.

In order to keep pace with evolving money laundering and terrorist financing threats, various Regime partners conduct assessments and publish strategic intelligence reports to provide policy makers with the information needed to address emerging gaps and promote awareness of emerging risks. This includes the Department of Finance Canada’s 2023 update of the National Inherent Risk Assessment (NIRA), which assessed the inherent money laundering and terrorist financing risks faced by specific sectors and products in Canada.

Recent reviews of the Regime have found that it is generally effective, with strong national policy and operational coordination. However, areas for improvement have been outlined in various assessments, including Canada’s 2016 FATF mutual evaluation report, the 2018 Parliamentary Review of the PCMLTFA, and most recently, in the Regime’s Report on Performance Measurement Framework 2019-20. These include weaknesses in information sharing, low levels of money laundering and terrorist financing investigations and prosecutions, as well as legislative gaps, such as the coverage of the legal profession and issues regarding beneficial ownership transparency.

In order to respond to this evolving context and to address identified gaps, the Regime Strategy provides the Government of Canada’s plan to combat money laundering and terrorist financing throughout the 2023-2026 period. These priority actions are grouped under four themes: 1) increasing operational effectiveness; 2) addressing legislative and regulatory gaps; 3) improving Regime governance and coordination; and 4) contributing to international community efforts to combat money laundering and terrorist financing. The Strategy is intended to complement the 2023 Parliamentary Review of the PCMLTFA, which will explore in greater depth how Canada’s AML/ATF Regime can remain responsive to the evolving ML/TF threat environment and further advance these strategic priorities.

This is the first AML/ATF Regime Strategy published by the Government of Canada and demonstrates the importance of public accountability and transparency to the success of the Regime. As the Regime’s operating context continues to evolve, the Regime Strategy will be revisited and updated to reflect future actions.