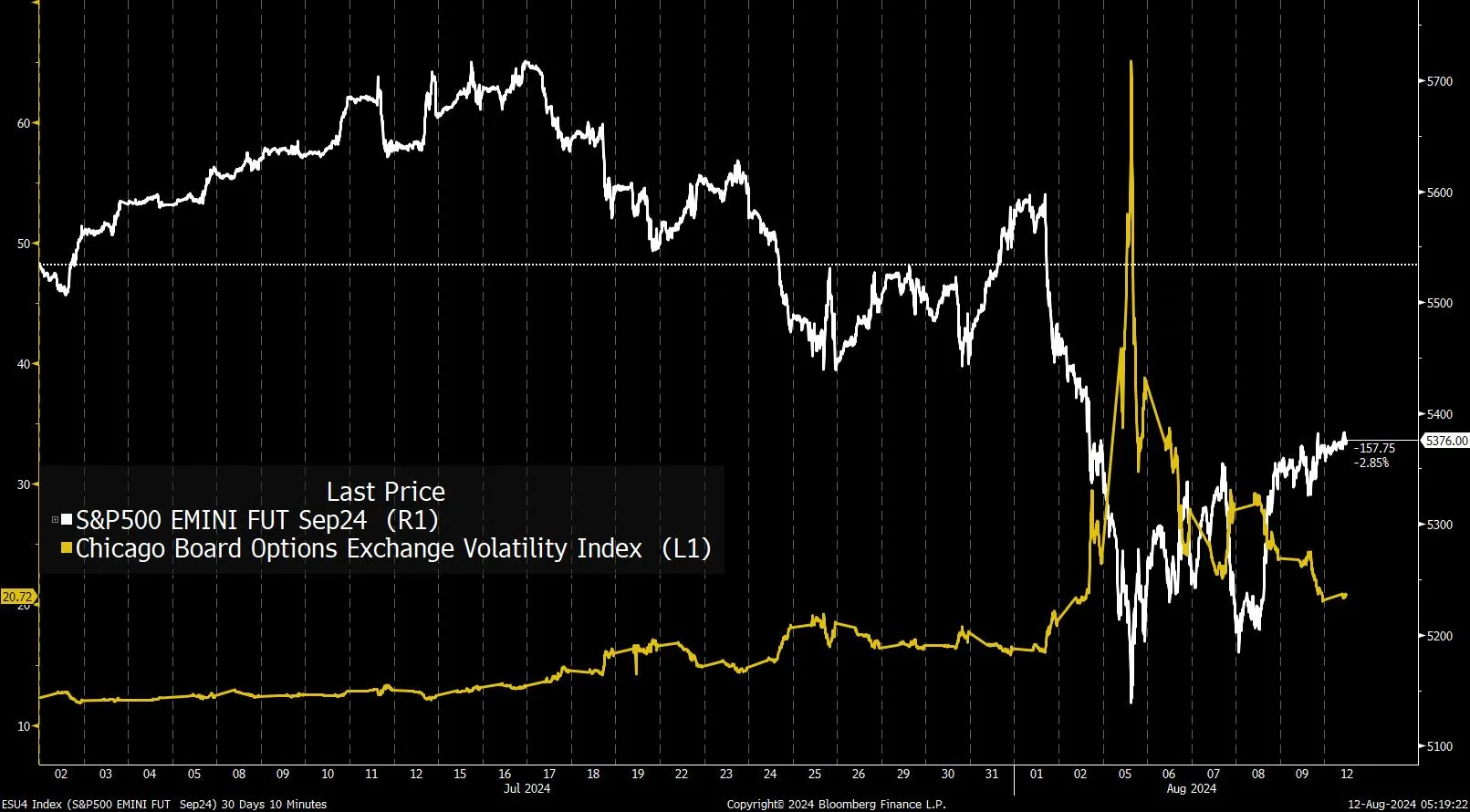

US futures are pointing to a slightly positive open, following gains from most European equity sectors, as traders await key data this week which will shed light on the health of the US economy and the outlook for the Federal Reserve’s interest rate path. The Cboe volatility index has retreated from a peak last week, which was fueled by concerns the Fed is waiting too long to cut borrowing costs. The yen dropped the most against the dollar among major peers, while treasury yields rose. Oil extended last week’s gains as some top US oil refiners throttle back operations at their facilities, adding to concerns a global glut of crude is forming.

Inflation watch

The US consumer price index is expected to have risen modestly in June, but that may not be enough to derail the Fed from a widely anticipated interest-rate cut next month. At the weekend, Fed Governor Michelle Bowman said she still sees upside risks for inflation and continued strength in the labor market, signaling she may not be ready to support a rate decrease. Money markets have fully priced a rate cut in September and about 100 basis points of easing for the year. Meanwhile, the options market is pricing in added volatility around both Wednesday’s US inflation report and Jerome Powell’s Jackson Hole appearance later this month.

Bonds are back

The latest equities slump, sparked in large part by fear the economy is slipping into a recession, has shifted the backdrop in favor of bonds. Expectations for rate cuts have mounted fast, and bonds do very well in that environment. This week sees July reports on US producer and consumer prices which bring plenty of risk for bulls. Any sign of a resurgence in inflation could push yields back up.

Carry trade

Theyen carry trade, as it’s known, was a sure-fire recipe for easy profits: borrow money in Japan at low interest rates and plow it into higher-yielding assets. But the way last week’s market meltdown unfolded so rapidly — and just as quickly faded — exposes how vulnerable markets are to the strategy that hedge funds exploited to bankroll hundreds of billions of dollars of bets in virtually every corner of the world. The recent turn has likely tamped down the carry trade, at least temporarily, with traders anticipating more volatility in foreign-exchange markets this year.

Funds fight

“Creditor on creditor violence,”where lenders scrap over how much money they can get back from ailing companies, has never been as rampant as now. With many businesses desperate to lower crushing interest costs, they’re becoming cutthroat. Amid this rush to restructure, some credit-focused funds are building a wall of money to help secure their own lending positions in emerging conflicts — and to profit from the mayhem. You can read more about the trend and its implications in today’s Big Take.

What We’ve Been Reading

This is what’s caught our eye over the past 24 hours.

- ECB to cut key rate six times by end of 2025, survey shows.

- FTSE 100 gains to erase decline from selloff.

- How inflation and high mortgage rates have hampered divorce in the UK.

- Foreign investors pull a record amount of money from China.

- Olympic gold medals are worth more than ever.

And finally, here’s what Joe’s interested in this morning

Good morning. A week ago at this time, the market was in the throes of a huge plunge. Now that’s been erased. However, the market remains well below recent highs, and the VIX is still elevated compared to where it’s been.

The highlight of this week will be on Wednesday when we get the CPI report for July. Economists are expecting a very normal 0.2% increase in the core rate for the month. We’re at a moment where the labor data has come more into focus than the inflation data. But obviously for the Fed to feel comfortable with easing, the inflation numbers will have to cooperate. Speaking of labor data, on Thursday we get the next installment of Initial Jobless Claims. Last week, when we got that benign claims number, the market took off, which is a sign of how jittery traders are about the possibility that the Fed is rapidly losing the employment side of the mandate. Expectations this week are for a slight uptick to 236K from 233K.

null

Also it probably won’t be market moving, but I’m interested in seeing what the UMich sentiment number shows on Friday. There’s been a major “vibe shift” (as the kids say) over the last month. There was a recent poll that showed Kamala Harris as more trusted on the economy than Donald Trump. That makes sense in terms of general polls, models, and betting markets giving her a slight edge. But it’s odd given the dismal marks that have been given to President Biden for almost his entire term. And though we don’t have much in the way of a concrete policy platform from the Harris campaign, it’s hard to imagine it being too different from the existing administration. But the polls are the polls and so it’ll be interesting to see whether the big shakeup of the last month somehow filters into some of the non-politics survey data.

Follow Bloomberg’s Joe Weisenthal on X @TheStalwart

— With assistance from Joe Weisenthal and Nick Bartlett