Sam Altman Pitches Utopian impact of Accepting UAE Oil Money Funding

The future of AI is bright, it’s AGI of Sam Altman’s variety where the elites work together against our common enemies.

SEP 24, 2024

∙ PAID

“In the next couple of decades, we will be able to do things that would have seemed like magic to our grandparents.” – Sam Altman (in his latest Op-Ed).

Hello Everyone,

Things are getting weird in AI again, OpenAI thinks it’s worth $150 Billion while Anthropic thinks it’s worth $40 Billion, while Sam Altman penned an essay that feels like it was written by AI.

(☝—💎For a limited time get a Yearly sub for just $5 a month✨— ☝).

GIP is now BlackRock’s infrastructure investment unit and Sam Altman managed to convince them to team up with Microsoft to start the AI infrastructure plan to siphon oil money from the UAE and Saudi to build the future of AI datacenters, next-gen Energy and AI chips for his startup OpenAI.

MGX, a United Arab Emirates (UAE) state-backed technology investment company is involved in OpenAI’s latest funding round and the above Microsoft Consortium for AI infrastructure called GAIIP. This is the project Sam Altman was raving (7$ trillion according to OpenAI’s comms team) at the start of the year that needs $Trillions in funding to manifest.

MGX, the United Arab Emirates (UAE) state-backed technology investment company, is reportedly considering participating in a multibillion funding round for OpenAI in addition to this, where OpenAI apparently insists a minimum of $250 million is required to participate, according to the Information. That MGX is both part of the Consortium and OpenAI’s funding round is directly due to Sam Altman. His version of “God-mode” is simply to lure oil money out of the Middle East to create an AI hegemony for U.S. led interests and to benefit their international partners.

Trying to paint a utopian vision for Generative AI’s end-game of AGI, is all part of Sam Altman’s warped PR campaign that reminds one of SBF, who ironically had invested in Anthropic on the grounds of AI safety. Meanwhile Microsoft is getting in bed with the AGI hype in what is shaping up to be very probably, a massive ponzi scheme:

“I believe the future is going to be so bright that no one can do it justice by trying to write about it now; a defining characteristic of the Intelligence Age will be massive prosperity.” – Sam Altman

Sam Altman is a fairly prolific investor on a personal basis and his generic PR and ability to lure tycoons into his games is one of his defining features, and frankly, one of his best qualities as a CEO.

OpenAI’s 5 Stages of AGI

OpenAI under the leadership of Sam Altman has reportedly presented a five-step roadmap to track its progress towards achieving Artificial General Intelligence (AGI).

Level 1️⃣ : Chatbots, AI designed for conversational interactions

Level 2️⃣ : Reasoners, capable of human-level problem-solving

Level 3️⃣ : Agents, systems that can take actionable steps

Level 4️⃣ : Innovators, AI that can assist in the invention process

Level 5️⃣ : Organizations, AI that can perform the functions of an entire organization

They claim that their o1 model achieves their Level 2 in (commercial) AGI. I’m putting commercial in brackets because OpenAI has copted the AGI definition to suit their own product strategy that significantly impacts their ability to fundraise absurd amounts that will likely reach tens of Billions in the not so distant future.

- Let’s explore some of the latest news around this in a bit more detail including how the Middle East is betting big on AI.

- How monopoly capitalism will shape the global order.

Bringing oil money into the equation is Microsoft and Sam Altman’s bright idea to save OpenAI’s future to manifest AGI. UAE technology investment company MGX is part of a new $30 billion initiative, which will invest in building data centres and energy infrastructure.

Other members of the Global AI Infrastructure Investment Partnership (GAIIP) are US-based BlackRock, Global Infrastructure Partners and Microsoft. Except that Blackrock owns GIP, and Microsoft is already in bed with Sam Altman. The Middle East is a national security risk already as they have been known to work directly with China, even though Microsoft has now also invested $1.5 billion in the United Arab Emirates’ top artificial intelligence firm, G42, after the Abu Dhabi-based company worked out an unusual deal with the US government to end any cooperation with China. Impossible to verify and, an unlikely story.

The U.S. is weaponizing oil money from the Middle East in order to try to build a firewall against China’s rising capabilities in AI and Microsoft is not just involved, they are instrumental. However in reality the vacuum caused by the exodus of U.S. investment in China has been filled, you guessed it, by the Middle East and likely MGX is heavily involved. They are playing both sides. Sam Altman’s super power is not making lame generic statements about AI ushering in an age of Prosperity but rather, schmoozing with Billionaires, tycoons and the ultra elites and fundraising for his AGI agenda (which will also make them more powerful).

According to the CNBC, Oil-rich nations like Saudi Arabia, United Arab Emirates, Kuwait and Qatar have been looking to diversify their economies, and are turning to technology investments as a hedge, with AI as their prime focus. OpenAI is raising likely a round of between $6 and $8 Billion., an unprecedented amount for an AI startup with additional backing by Microsoft, Apple and Nvidia expected in the round, that is somehow set to value OpenAI at $150 billion, and could soon overtake the likes of SpaceX and ByteDance to be the most valuable private Unicorn startup in the world.

OpenAI and TSMC’s A16

If NVIDIA has been announced as a technology partner for GAIIP, leveraging its expertise for AI centers and factories, this means TSMC will be involved as well as we know they have a commitment already to OpenAI for A16 AI chips. OpenAI is expected to be getting help from Broadcom and Marvell to design the chip. Sam Altman’s consortium for OpenAI’s future is right on track. All of this makes the likes of Masayoshi Son look like a failure with his ill fated Softbank Vision Fund that made a number of poor bets and also catered to Middle East ambitions with its own AI agenda before Generative AI took off in what was actually an AI winter period.

OpenAI will in the meantime have to do a ‘hard pivot’ just to make this funding round possible, which will include a new logo. OpenAI has been working on the new logo, which has a very different vibe from its current, flower-like hexagonal logo, for a year. The effort has been mainly internal, leveraging the expertise of new hires from creative industries. Historically OpenAI works and operates as a “capped” for-profit LLC controlled by a non-profit, but in 2025 that will likely be no more. Under Microsoft and Sam Altman, things have been taken in an entirely new direction. Product, profit and AGI.

“Many of the jobs we do today would have looked like trifling wastes of time to people a few hundred years ago, but nobody is looking back at the past, wishing they were a lamplighter. If a lamplighter could see the world today, he would think the prosperity all around him was unimaginable.” – Sam Altman

Microsoft hustling for Sam Altman’s investments is nothing new. You’ll scratch my back if I scratch yours. As they are commercially tied to OpenAI doing well. Whatever that means when you are losing up to $4 Bn. a year. GAIIP wants to leverage at least $100 Bn. in investment potential to bring new energy capabilities to all of this radical momentum including debt financing. OpenAI is projected to lose approximately $5 billion in 2024, primarily due to the high operational costs associated with running its AI products, including ChatGPT, absurdly expensive staff and an appetite for dilution Sam Altman doesn’t seem outwardly particular concerned about. Sam Altman is a bit like a new kind of Millennial Mafia Tech tycoon. But if OpenAI’s new funding round is only $7 Bn, that means they think they can become profitable fairly soon.

Monopoly Capitalism on Steroids of Generative AI

BigTech is becoming more centralized and the U.S. is beginning to dominate parts of the world and other regions to a dangerous degree with Generative AI becoming the dominant trend. Even while Europe has the EU AI Act, their economy is sputteringand their Generative AI labs are shutting down. I do not expect France’s Mistral to make it as a commercial entity that builds LLMs. Generative AI under the watch of Satya Nadella and Sam Altman is tightening the AI arms race to just a few players.

Nvidia too gets nearly half of its revenue from just four major customers driving the Generative AI wave – they are Microsoft, Meta, Google and Tesla/xAI. While the customers are anonymous in Nvidia’s 10-Q regulatory filing, “Customer A” made up 14% of Nvidia’s revenue, while two customers made up 11%, and the fourth made up 10%. Those sales — representing about 46% of its revenue, or $13.8 billion — “were primarily attributable to the Compute & Networking segment,” the company said.

As the datacenter expansion push becomes a lot more tangible in the 2025 to 2030 period, a few monopoly corporations in the U.S. are going to be ploughing Billions more capex into the end-game, dominate the world in AI and attain AGI like AI Supremacy. In 2023, Microsoft contributed 19% of Nvidia’s revenue. Sam Altman is orchestrating monopoly capitalism like we have never seen before. Amazon has most skin in the game through their $4 Bn. investment in Anthropic, one of OpenAI’s main rivals, along with Google and a bevy of surprisingly competent Chinese Generative AI startups.

Thrive Capital, Josh Kushner’s venture capital firm for their part are investing well over $1 Bn in this current mega round that has yet to be finalized but which I expect will be more than the $6.5 Bn. reported. I guess Sam Altman got to him too. It makes sense also that Nvidia is investing since they are so directly tied to OpenAI doing well through their biggest customers called Microsoft. Compared with Microsoft, Meta and Google (and even Tesla/xAI for that matter), Apple and Amazon could be considered out of the picture in terms of being drivers of the current cycle of AI innovation. While the three biggest Nvidia customers are obviously Microsoft, Meta and Google, the four listed could actually be Tesla/xAI, and not Amazon as so many assume. Amazon is on its back foot in Generative AI innovation.

Sam Altman’s best hope to save OpenAI from the massive gambles it’s making as a product-driven company under Microsoft, was to lure Middle Eastern wealth. This is the key to defeat China, at least temporarily the U.S. think tanks suggested. It’s also an experiment that’s the most centralized and controlled by the fewest key people, elites and monopoly companies in the history of innovation. It’s going to herald a Silicon Valley that is blazing a dystopian trail. Leave it to Sam Altman to claim just the opposite:

“If we want to put AI into the hands of as many people as possible, we need to drive down the cost of compute and make it abundant (which requires lots of energy and chips). If we don’t build enough infrastructure, AI will be a very limited resource that wars get fought over and that becomes mostly a tool for rich people.” – Sam Altman

With OpenAI abandoning its idealism, non-profit structure, capped profit structure, the fundamental idea behind OpenAI LP will be no more. They will likely rebrand into a new name given the embarrassing nature of the company name compared to its founding ideals. Sam Altman is an investor at heart and runs his company like a mafia enterprise. Submitting to Microsoft’s commercial pressures and an Uber-like ruthlessly in talent acquisition and product development is what it takes to become a monopoly yourself with ChatGPT’s stunning adoption over the last two years.

US-based AI chip company Nvidia will provide expertise in AI data centres and AI factories to GAIIP meaning this consortium of elites won’t be a vehicle for civilization’s abundance, but U.S. national security interests and American exceptionalism. Because no, a strategic rival (supposedly that would have been China) is not really allowed in the current world order dominated by just one super-power, the United States.

Sam Altman is then, the Captain America of AI of our times. Scrutinize his generic doctrines, and speaking opps and you get a sense of what the elites have planned for us.

You might remember in March, 2024 Abu Dhabi launched MGX, an AI-focused investment vehicle, with sovereign wealth fund Mubadala and AI company G42 as its founding partners. It’s “show time” and companies like Nvidia and TSMC are obviously going to become even more important in the new world order (NWO). What sorts of technology

AI Infrastructure for American Exceptionalism

“Mobilizing private capital to build AI infrastructure like data centers and power will unlock a multi-trillion-dollar long-term investment opportunity,” said Larry Fink, Chairman and CEO of BlackRock. “Data centers are the bedrock of the digital economy, and these investments will help power economic growth, create jobs, and drive AI technology innovation.”

Players like Microsoft and the U.S. get to choose who the winners will be. This isn’t a global free market system we live in any longer. TSMC’s A16, refers to a 1.6nm node, that will eventually be the successor to the chip manufacturer’s N2 node. Apple and OpenAI are first in the pecking order.

“The capital spending needed for AI infrastructure and the new energy to power it goes beyond what any single company or government can finance,” said Brad Smith, Vice Chair and President of Microsoft. “This financial partnership will not only help advance technology, but enhance national competitiveness, security, and economic prosperity.”

Sam Altman might be creating a new world order where OpenAI’s concept of AGI is a new vehicle to funnel wealth back home to the USA while inhibiting China’s economic or technological ability to compete strategically with the U.S. So the AI arms race has come to this. People think my Newsletter name called AI Supremacy refers to something odd, but monopoly capitalism armed with Generative AI can turn out fairly badly for human civilization. It also dramatically increases the probability of global conflict and is hurting the global economy due to imbalances in who benefits.

It was first reported in July 2024 that OpenAI had been in talks with chip designers to discuss the possibility of developing a new AI server chip. The company’s CEO Sam Altman has long been pushing for OpenAI to develop its own AI chips. OpenAI is also working famous Apple designer Jony Ive has now confirmed he’s working on a new device with OpenAI. OpenAI are also expected to integrate advanced voice mode into ChatGPT soon. OpenAI’s PR and Comms team is now a massive bureaucracy with Sam Altman as the head maestro.

According to some onlookers OpenAI’s o1 that uses CoT and RL more than previous models is being heralded as the biggest breakthrough since GPT-4. OpenAI can have all the love of Jony Ives, but all of Sam Altman’s funding abilities means OpenAI might be too well financed at the end of the day to fail. They have 11 million paying customers and 1 million of which is their expensive Enterprise higher level tier.

Microsoft got early access to GPT-4 and still managed to bungle their AI products. Getting earlier access to o1 is not likely to elevate them to the level of Anthropic or Goggle anytime soon. But Microsoft is expanding their datacenters in Southeast Asia and key parts of the world and boosting Azure’s growth in part due to their Generative AI prowess. Every percentage point of Cloud growth Azure grows faster than Amazon’s AWS and Google Cloud means Billions in future revenue. The absurd capex spending in AI of Meta or Tesla is less obviously beneficial to them in the long-term. The austerity and layoffs of Meta Platforms compared to their wastage of Billions on Metaverse hardware and AI truly is baffling.

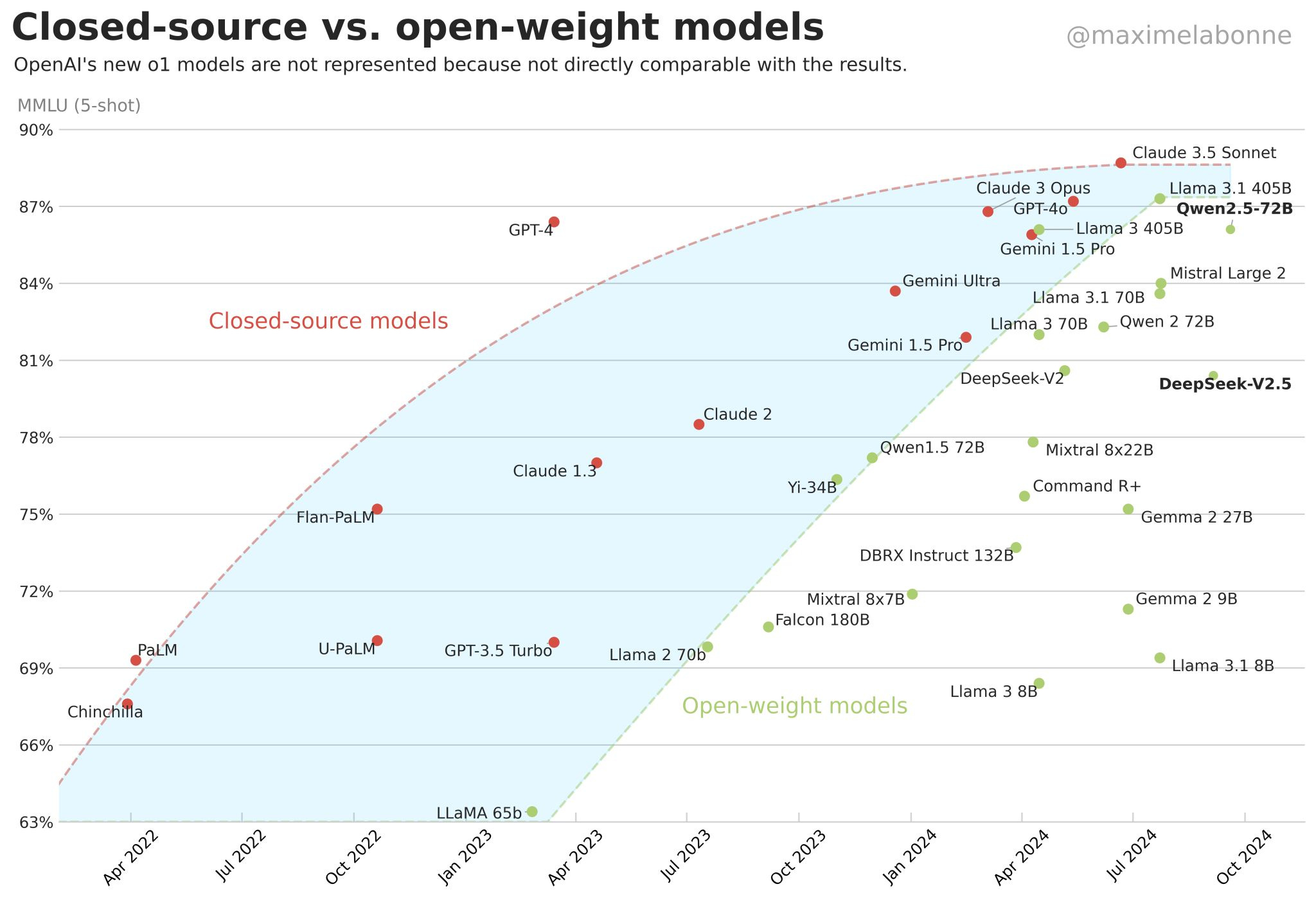

Inspite of Meta’s grand investments in Llama and the impressive adoption, China might soon overtake the U.S. in open-source LLMs if Maxime Labonne’s graphic is anything to go by and the gushing of Hugging Face (who I assume would know a thing or two about “open-source” models) over Alibaba Cloud’s Qwen models. See Maxime’s reasoning here. If OpenAI is so great, why is China catching up to the U.S. in open-weight LLMs? OpenAI is about as closed and secretive as they come when it comes to their models on top of hoarding the world’s top talent.

Meanwhile Microsoft are funding a future competitor in OpenAI that might steal Bing’s Advertising marketshare in Search one day with SearchGPT, that ironically uses Bing’s capabilities in part. Anything for Nadella to get his bonuses before he departs I guess as CEO. If other avenues don’t go as expected, OpenAI can with the new funding really push SearchGPT into a good position with the ChatGPT traffic it’s getting and get into Search Advertising stealing some of Google’s share, that it is functionally already doing with ChatGPT traffic. OpenAI have more levers to pull than most critics realize or have analyzed.

UAE, Brokers of the Future of AI?

To make Middle Eastern oil money collusion in U.S. exceptionalism makes matters even more complex, as it turns out Samsung and TSMC have reportedly discussed building AI chip “megafactories” in the UAE. Semafor is not crazy when it talks about the Middle East trying to build a home-grown AI hub on their oil wealth territory. Oil wealth will desperately try to be part of this brave new world.

Comparing Sam Altman to SBF here is also not crazy. In the not so distant past, the UAE, both Dubai and Abu Dhabi have embraced the technology, turning the regions into hubs for crypto innovation. Generative AI for 2025, seems to be part and parcel a similar scheme. Sam Altman knows a Billionaire cash-cow when he sees one. A lot of the oil nations didn’t get wealthy by merit exactly. They are privileged.

The rise of G42 making deals with Microsoft and MGX feels a bit odd, and it’s from tycoon oil money but also sets a new geopolitical rush for regions by the U.S. and China on a level of national and economic competition. Mubadala and G42 serve as foundational partners in the creation of the new company MGX. Mubadala Investment Company is a prominent sovereign wealth fund based in Abu Dhabi, actively investing in artificial intelligence (AI) as part of its broader strategy to enhance its portfolio and drive economic growth. Sam Altman is courting international partners and the world’s elite to build an empire, but what is the end-game exactly? But is OpenAI worthy of such a stage and such funding bonanza and shenanigans?

In reality, Mubadala is mostly betting on India and China where it sees substantial potential for AI-driven growth. This makes the Middle East a metaphorical and investing bridge between East and West in the future of AI. How important will the UAE and Saudi become? TSMC’s global expansion in Japan, Germany and Arizona is the stuff of legends of course that Americans don’t know or talk about. America’s relatively poor innovation is compensated for with more funding, bigger partners and more monopoly BigTech players, but in the long-run that might not even be enough.

With the probable fall of the American Intel, TSMC and Samsung would be the remaining duopoly. In 2024, the AI chip foundry market is primarily dominated by two major players: Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Foundry. TSMC holds a commanding market share of approximately 62%, making it the leading entity in the semiconductor foundry sector, particularly for AI applications. TSMC is years ahead of Samsung and I think A16 will show that. TSMC’s dominance in execution and R&D is now too good. Even as Nvidia’s lead in AI chip GPUs is so strong.

Sam Altman’s essay is problematic, compared to the collusion and elitism of his activities. This is what makes OpenAI’s funding round so interesting to witness. It’s unprecedented and is a pitch that OpenAI can become a generational company and maintaining its dominance as a first-mover in Generative AI products. It could in theory acquire Perplexity and challenge Google with ChatGPT’s traffic. Perplexity while an admirable search and research tool, is struggling to get mainstream adoption. An exit is highly probable.

The essay is titled The Intelligence Age, and is fairly poor copyrighting. It’s almost making grandiose claims reminiscent of Google DeepMind.

“We need to act wisely but with conviction. The dawn of the Intelligence Age is a momentous development with very complex and extremely high-stakes challenges. It will not be an entirely positive story, but the upside is so tremendous that we owe it to ourselves, and the future, to figure out how to navigate the risks in front of us.” – Sam Altman

Is OpenAI a generational company or just an AI startup that navigated all of these kingdoms, both technological and political, under the genius of Sam Altman successfully? Or did it take too many risks in the process? We won’t really know until this all plays out.

OpenAI’s adoption of ChatGPT and its revenue growth has been outstanding in 2024. By the end of 2024, OpenAI’s annualized revenue is projected to reach $3.4 billion, marking a significant increase from $1.6 billion in the previous year. If 2025 goes well from a product and revenue growth side, OpenAI should be fine. And if it makes it over the 2025-2027 hump companies like Google, Microsoft, Amazon and Meta will be in trouble as they by 2028 go more into advertising. This is not hypothetical, it’s almost inevitable. If you understand the history of how Netflix, Amazon and even Uber got into Advertising.

Will Sam Altman usher in an age of abundance? Was his essay written in part by o1 or an OpenAI model? How far will he go for American exceptionalism, now that OpenAI works directly with the Pentagon? What will the environmental costs be and how might it position himself and Microsoft to benefit from the switch to new forms of energy. A surging cloud player Oracle is also looking into powering data centers with Nuclear. Microsoft, Nvidia, OpenAI and their collusion of elites have too much riding on all of this to stop. The momentum of AI datacenters and supercomputers will eat the world, not taste. This is an AI arms race, and there are fewer and fewer real players left in the game.

AI Supremacy in the context refers to the national and corporate battle over who wields the future fruit of the technology that has both extreme economic and military ramifications. AGI isn’t a tangible thing, it’s a metaphor for this commercial and IP power. People like Sam Altman, Elon Musk and Mark Zuckerberg want it for themselves and their companies. AGI like a Lord of the Rings-esque, ring of power, and that’s is a dangerous thing.

There are a lot ways where OpenAI’s dominance with ChatGPT could go wrong for both Sam Altman and America. Letting the richest corporations control its future might have unintended consequences. This is why the U.S. government are increasingly working with BigTech. The Cloud changed everything. Silicon Valley has been reduced to a network of powerful relationships, and Sam Altman happens to be really good at this game.