Nov. 06, 2024 1:45 AM ETPalantir Technologies Inc. (PLTR) Stock7 Comments

2.58K FollowersPlay

(10min)

Summary

- Palantir surprised the market with a 30% YoY revenue growth.

- I argue that this is not good news, it’s great news. I expect this kind of growth to be sustainable, given what management has shown us is possible.

- This article covers the Q3 earnings report, and takes a pulse on Palantir.

- I am issuing an upgrade to strong buy on continued surprise strength, strong treasury, no debt, and continued profitability.

hapabapa

Introduction

I first recommended Palantir Technologies Inc. (NYSE:PLTR) back in June with a buy rating, when I wrote Don’t Underestimate Palantir’s B2B Prowess. Since then, the stock has more than doubled.

Seeking Alpha

I am personally long Palantir; I bought in shortly after the article was published, and am also up over 100% since then. However, I’m not necessarily here to gloat, but to cover Palantir’s Q3 earnings report, which was released this week, and resulted in a resounding approval from the market.

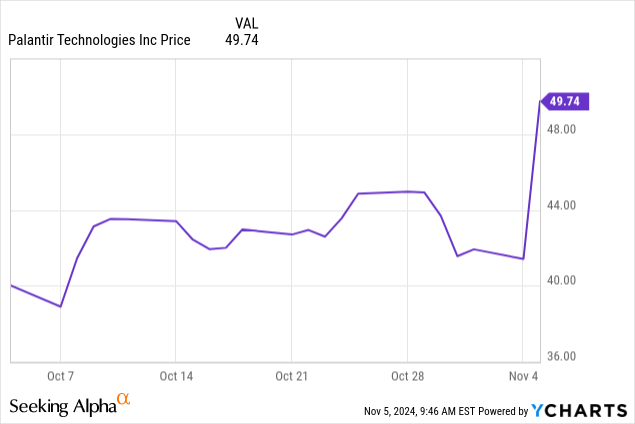

Data by YCharts

That single day jump was close to 15%, which was an exciting day. Palantir has now eclipsed its former heights and reached a new one.

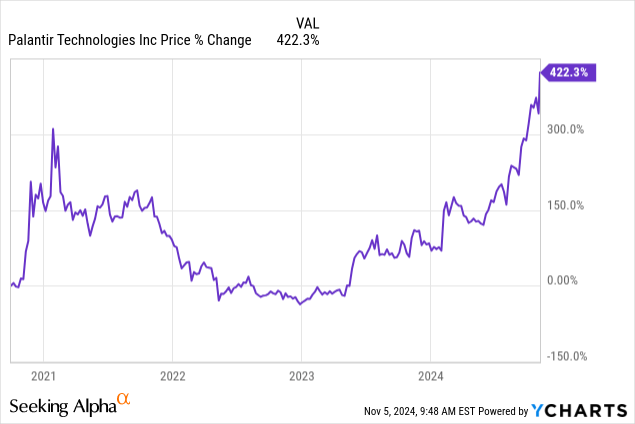

Data by YCharts

Short History

“Data analytics” is a rather vague term, and much of Palantir’s business is obfuscated through that kind of hand-waving jargon. For example, here is Palantir’s explanation of what they do, from their website,

We build software that empowers organizations to effectively integrate their data, decisions, and operations.

The best way I can put it for the majority of readers to understand: Palantir develops software that is designed to be the backbone of a corporation. All of their data is fed into this software (which I’m going to call an “operating system” or “OS” from here on out), and then the software analyzes that data using AI models and proprietary algorithms to find deficiencies, misallocated resources, and inefficient processes. The OS then enables “operators” (from businesses to governments to NGOs) to resolve these issues and streamline their operations from top to bottom.

The primary “skill” being employed by the software is pattern recognition. The Palantir platforms can pour through millions of data points and “find the needle in the haystack” so to speak; that is, some pattern in the data that human operators missed or didn’t have the resources or time to manual pour over. In our world, the pool of data on individuals and in the world climbs every day.

They’ve got a few big accomplishments under their belt from their 20-year tenure in the data business:

- An early investment from the CIA’s venture capital fund, In-Q-Tel

- Uncovered “GhostNet,” a Chinese-based spy ring of nearly 1,300 infected computers that had infiltrated the Dalai Lama’s office, a NATO system, and national embassies

- Deployed across the Medicare and Medicaid networks to find fraud

- Assisted in the location of Al-Qaeda leader and 9/11 orchestrator, Osama bin Laden

- Its software was used to source recordsfor Bernie Madoff’s conviction

- Current and former clients include the CIA, the Department of Homeland Security, the NSA, the FBI, the CDC, US Marine Corps, Air Force, and Special Operations Command; the FDA, Los Angeles PD, US ICE, the English NHS, and more

Welcome to the S&P 500

The announcement of the firm’s inclusion into the S&P 500 was a big one, as it lends more legitimacy to the company as well as provides a boost to the share price since funds that track the index will need to buy PLTR shares at their next rebalance (depending on the fund).

This kind of announcement hype is not always long-lived, so I am cautious of it, but for now, it is a boon to PLTR.

Palantir Q3 Earnings

Our third quarter results for PLTR were interesting, mostly because of the headline 30% boost to revenue.

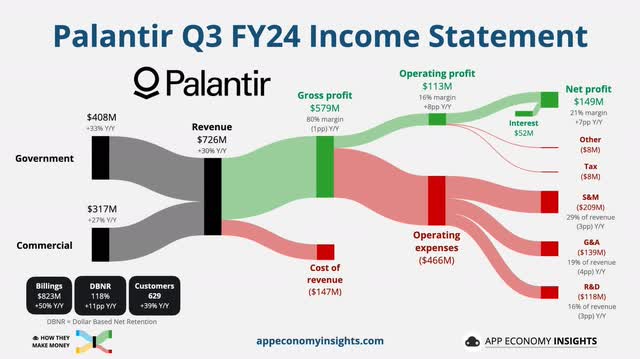

Here’s a quick overview of where the money came from and went to.

I really appreciate the author of this particular series, App Economy Insights on Threads.

App Economy Insights

Other notable performance metrics that management noted aside from the broad increase in business more generally are:

- Domestic revenue grew 44% YoY

- Closed 104 deals over $1M in Q3

- Rule of 40 score of 68% (a new high)

- Partnership with Ukrainian government to work on de-mining operations

- Expansion of Maven program with continued US funding

Financials

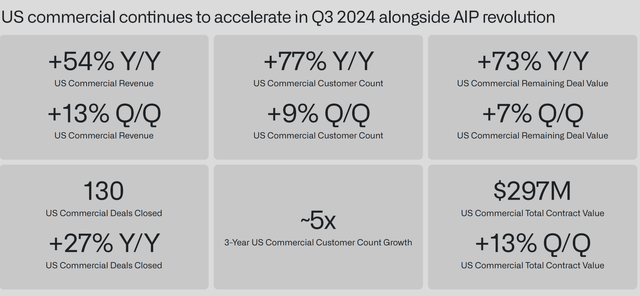

Palantir continued to expand its commercial operations, one of the facets of PLTR that I am most bullish on, and expanded their revenue 13% QoQ, and 54% YoY. This was coupled with a 77% YoY increase in customer count, further diversifying their base and revenue streams. This assuages some customer concentration risk PLTR has with its US military business.

Palantir

Most importantly, we can see that the total value of the current commercial contracts has increased at a faster rate than customer count, showing us that these new customers are, on average, higher paying customers than existing ones. If all customers paid the same tabs, we should expect a linear relationship between these metrics.

I am also impressed with how much commercial revenue has grown, as it used to make up such a small piece of PLTR’s overall, with the government contracts formally dominating their portfolio. Now, these two figures are almost neck-and-neck.

GAAP net income was up to $143M, up 100% YoY. GAAP EPS was at $0.06. This was great news, as profitability continues and strengthens. A doubling of GAAP earnings is a very positive sign for any company, and can justify a price movement of similar stature.

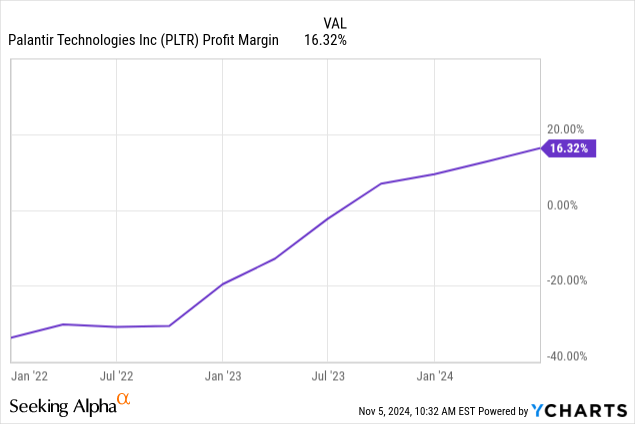

Alongside this, margins grew to 16%, from a several-year-low of nearly (40%). The turn-around time was quick, but we can see the trend slowing as we begin to approach diminishing returns on margin growth.

Data by YCharts

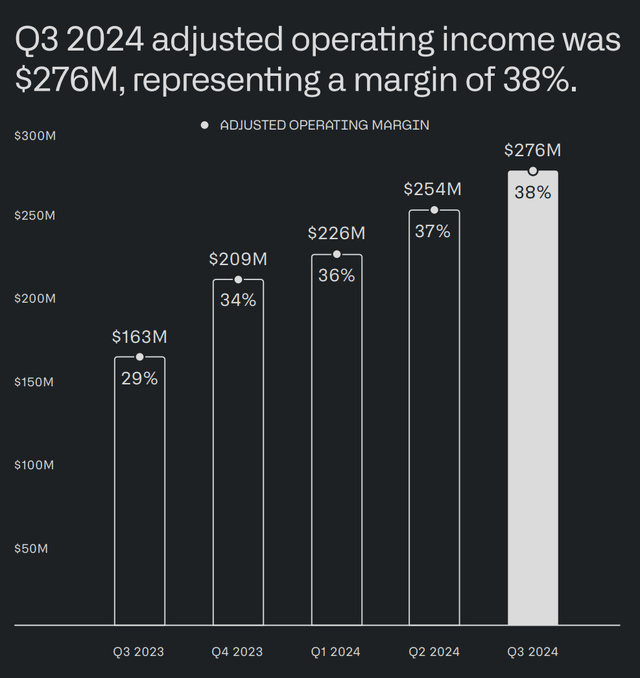

This money, and the new heights in profit margins, is paid invested “aggressively,” as management put it in the earnings presentation. They say that this has brought their operating margin up to 38%.

Palantir

They ended Q3 with a ton of cash sitting on hand, and no debt to speak of. This is a great place for a business to be operating at, as it means that their solvency is without question. They ended the quarter with $4.6B in cash and equivalents.

For context, there are 25 countries with less cash in their foreign reserves.

Expectations

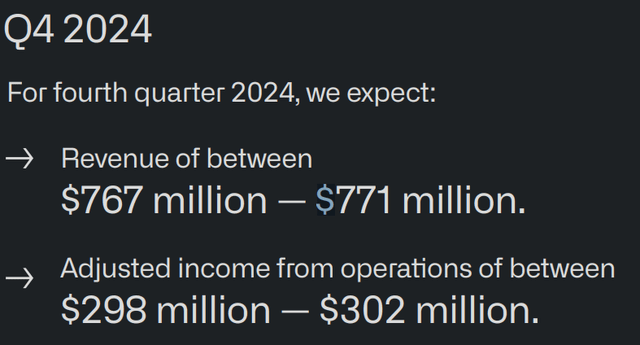

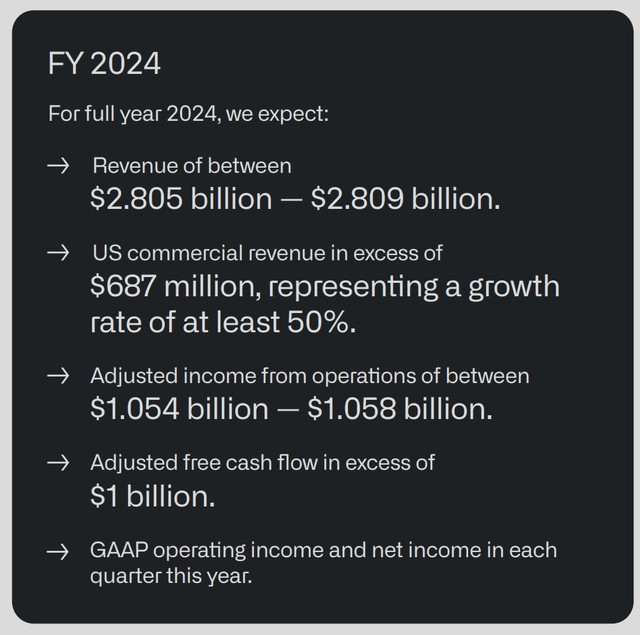

For the next quarter, PLTR is expecting a 5-6% QoQ increase in revenue, and a similar change in operating income. This would keep them on the right growth trajectory to continue justifying their valuation.

Palantir

For FY 2024, they are projecting a 50% growth in commercial revenue, and FCF of $1B+, something they have yet to reach. Q4 will need to impress to keep these numbers up.

Palantir

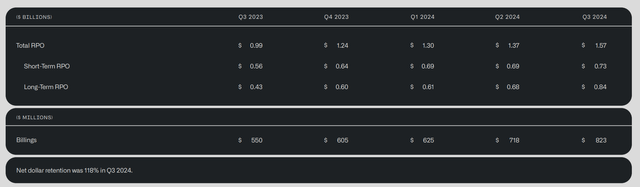

Other metrics to include is the total RPO, or remaining performance obligation, the amount they can expect to earn from, unfulfilled contracts. As they have added on more customers and more contracts, closing those 100+ deals, this figure has increased. Locking in contract value is a boon for PLTR, as it means they can project some level of forward earnings from these.

Palantir

Valuation

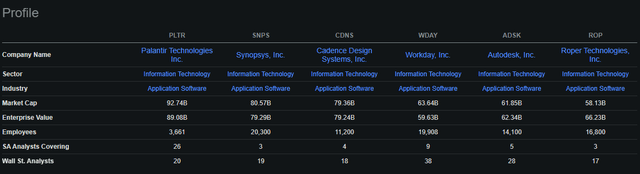

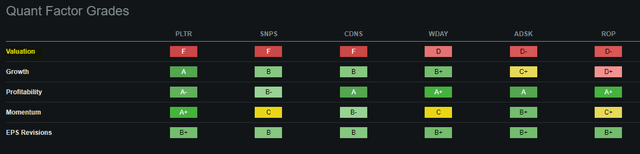

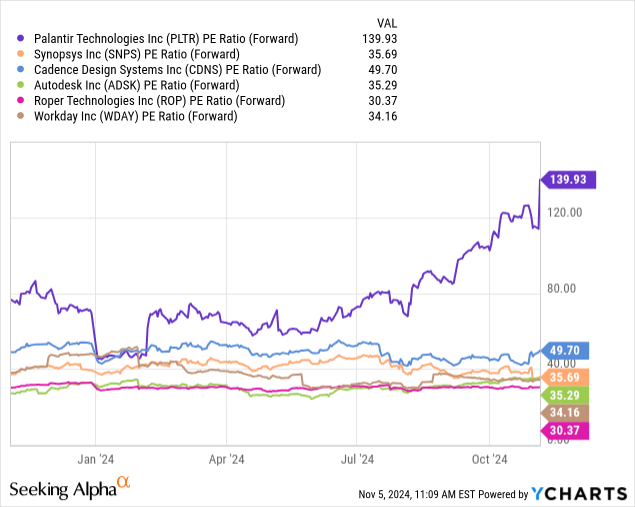

Here is the elephant in the room. When stocks run up like PLTR has, they can let their valuations get away from them. Compared to its competitors, PLTR carries a high PE ratio.

Seeking Alpha

To be fair, SA Quant rates all of them poorly from a valuation standpoint.

Seeking Alpha

When we look at forward PE, we see a better side of the story, but still, one that shows PLTR as very overvalued compared to its peers. One would need to set this aside to be comfortable owning this stock.

Data by YCharts

The biggest risk to PLTR is that it stands to fall much farther than its peers in the SaaS space because of this heightened pricing. If we enter a recession and PLTR’s business slows, it may be hammered far worse than some competitors.

I believe that would only be a buy signal, however, as I am very bullish on PLTR and believe in its continued justification of its high valuation. With the kind of growth that it is projecting, it makes sense to value it above other, slower enterprises.

Conclusion

PLTR is a stock that has run up tremendously, but risks remain in its valuation. Q3 earnings were very impressive, with many of the “must watch” metrics like customer counts and contract value up over previous expectations. The headline 30% revenue growth shook markets and propelled PLTR to new heights. Whether it can maintain these heights is yet to be seen, but for now, it seems to justify its insanely high valuation.

Commercial customer growth, further integration into the armed forces, and heightened revenue are all very bullish factors for PLTR that have led me to give it an upgrade to a strong buy, as I believe that it will eventually justify its valuation and come back to Earth, but that it still has more room to run. The company has just joined the S&P 500 and shows tremendous promise.

Just remember that risks still remain, especially with companies that have run up as much as PLTR has. It has a lot of room to potentially fall.

Thanks for reading.

2.58K Followers

Financial advisor and research analyst from Southern California.My work covers equities, funds, and fixed income; macroeconomic and geopolitical analysis; asset allocation, technical analysis, portfolio management, alternatives, and derivatives.”History does not repeat, but it does instruct.” — Timothy Snyder, On TyrannyFollow me @ https://linktr.ee/realjbowman

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.