Welcome to CFO Briefing, a newsletter devoted to corporate finance and what leaders need to know. This week, I take a closer look at the key challenges facing finance chiefs in 2025. We also have an interview with America Movil’s Carlos Garcia Moreno, who talks about the rationale for the company’s recent peso bond sales.

But first, here’s some other news that caught my eye:

- The world’s 500 richest people got vastly richer in 2024, hitting a combined $10 trillion in net worth.

- As the US’s debt balloons, firms that play a vital role in the world’s biggest bond market warn of growing pressures.

- Zhengzhou has tried so many ideas to revive its housing market that officials from other cities flock there to study its model. And yet, home prices in Zhengzhou and the rest of China keep falling.

Looking for events that are actually worth your time? If so, I have something for you: Bloomberg is launching a series of exclusive roundtable events for CFOs, starting with a breakfast meeting on March 5 in New York. We’ll talk about the art and science around earnings guidance and share Bloomberg’s latest insights. Interested? Send me a note at ntrentmannma@bloomberg.net if you want to take part.

Happy New Year

Like many of you, I spent the past week thinking about 2025, apart from enjoying some time in London. There are many potential scenarios. In fact, CFOs tell me they are preparing for a wider range of possibilities than in prior years, as we know some of the likely themes, but lack crucial details. Here are a few:

Trump and tariffs: President-elect Donald Trump’s plans to introduce new and sweeping tariffs are top of mind for finance chiefs. One important question is around timing, and whether Trump will implement changes straightaway.

The tariff threat is already forcing executives into action, with many CFOs focused on working capital management as inventory levels go up and supply chains become more expensive. As my colleagues reported, some companies are proactively searching for new suppliers, while others are ramping up orders before Trump’s Jan. 20 inauguration. Other CFOs say they would look for opportunities to reduce costs.

Assessing the financial impact of new tariffs is tricky, and Home Depot CFO Richard McPhail, like many of his peers, didn’t want to make predictions when I spoke to him late last year. “It’s too early to speculate on what stance the administration might take, but we have deep experience in operating in an environment with tariffs,” he said. The home improvement retailer adopted a so-called real-time planning cycle that allows the company to respond quickly, McPhail said.

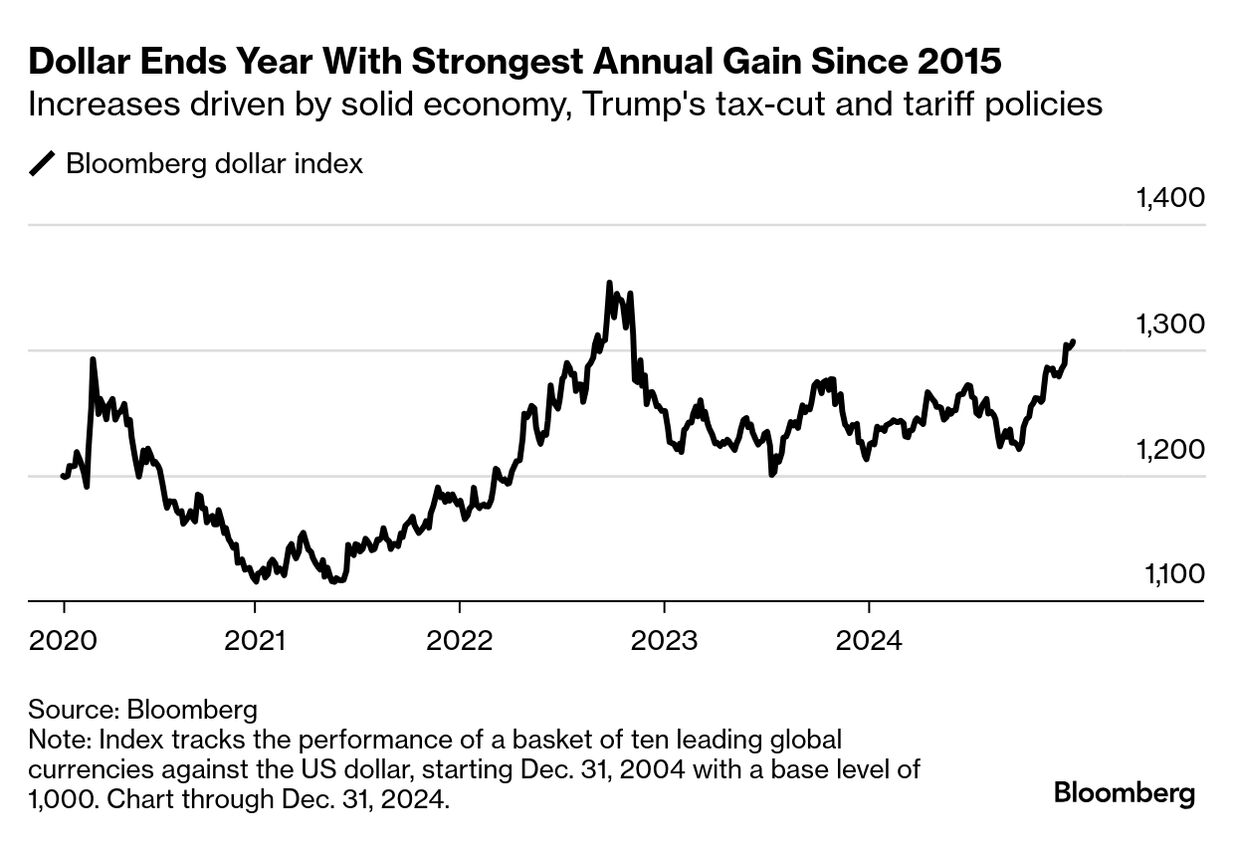

Dollar dominance: The US dollar had a good yearin 2024, and several people I spoke with in recent weeks, including CFOs, advisers and consultants, expect more of the same in the coming year. Increased currency swings (such as those in the Brazilian real) could also be in the cards, while countries like China may weaken their currency to try to offset US tariff effects.

For CFOs, this may require taking a more active approach to managing foreign exchange. “Increased currency volatility has spurred interest in foreign exchange strategies,” advisers at Chatham Financial wrote in a recent note. “Many clients are initiating cash flow and balance sheet hedging, reviewing existing FX programs, exploring cross-currency swaps.”

Interest rates: Falling interest rates in 2024 brought relief to many CFOs around the world. US and European finance chiefs expect that trend to continue, even though new tariffs could limit the scope for additional cuts if inflation goes back up. In the US, policymakers in December indicated two rate reductions for 2025 after lowering borrowing costs three times in a row.

Other central banks could take a cue from the US, depending on which policies Trump pursues. “The downside risks from US trade policy should keep the ECB cutting steadily to 1.75% and prompt China to ease (fiscal) policy more aggressively,” analysts at Goldman Sachs wrote in a note.

The Fed, led by Chair Jerome Powell, is seen continuing its easing path in 2025. Photo credit: Al Drago/Bloomberg

Dealmaking: Based on anecdotal evidence from bankers and finance chiefs, 2025 may turn into a decent year for deals. One of the key hurdles remains the gap between historically low strategic M&A valuations and elevated market capitalizations, according to a recent report by Bain. Lower financing costs and less regulatory scrutiny in the US could bring more transactions, depending on a few other factors, including Trump.

Ida Lerner, the CFO of Norway’s biggest bank, in a recent interview told me DNB would be open to acquisitions if the opportunity arises, following its recent purchase of Sweden’s Carnegie Holding. Joan Bottarini, the finance chief of Hyatt Hotels, also sees room for growth, including through acquisitions. Europe is “another big opportunity for us,” she said in early December.

AI: One area where CFOs might differ is on artificial intelligence. While some see potential for fundamental changes to their business models, most finance chiefs I spoke with in recent weeks appear to be viewing the technology more as a tool for enhancing efficiency, at least for the moment.

“We’re not trying to become a gen AI company,” said Don McGuire, the CFO of HR and payroll company ADP, referring to generative AI. “We’re taking the best tools we can find and putting those tools on top of what we know,” he said. While ADP has had good results, it’s still early days, McGuire said, echoing similar comments from peers.

A lot remains to be seen. One thing, however, seems clear to me: CFOs need to make sure they have a seat at the table, and get involved early on. As Deborah Golden, Deloitte’s US Chief Innovation Officer told me last month, finance leaders have to look beyond cost efficiency and tackle threats to existing business lines that may arise from the technology. Plus, come up with new opportunities.

The number

$1.9 trillionExpected gross issuance of US investment-grade bonds in 2025, which would be the highest ever, according to a forecast by Morgan Stanley.

The interview with America Movil’s Carlos Garcia Moreno

Carlos Garcia Moreno. Photo credit: America Movil

Carlos Garcia Moreno has led America Movil’s finances since 2001. The Mexican telecommunications firm has changed a lot during his tenure, consolidating its market in Latin America and elsewhere and growing through acquisitions and internal investments. Moreno worked for state-owned Pemex as an investment banker and for the Mexican ministry of finance before he joined America Movil. He talks to Bloomberg’s Andrea Navarro about the Mexican peso and tapping the local debt markets. His answers have been edited for length and clarity.

How much of a problem is the recent weakness in the Mexican peso for you?

At the operations level, there are some things that are imported, some licenses, some network equipment. And in those cases, the budgets are defined in local currency. So potentially you could buy less equipment. But what we have also seen is that in these conditions, we get good discounts from suppliers (to offset currency effects). So, to a large extent, the exchange rate effect ends up less with America Movil and more with the suppliers who continue to promote equipment offers.

America Movil is tapping the domestic debt market more frequently than in the past. Why?

We did three transactions in nine months. One for seven years, one for five years, one for ten years. What we raised was more or less three billion dollars. It was quite a significant amount in a space of nine months and with a good combination of local and international investors. Our idea is to be in the market two or maybe three times a year. It does not mean that we’re not going to do anything in other currencies. But we are going to give priority to placements in pesos.

The company had to rely on dollar and euro markets before. Talk about that.

Before, as a company, if you had important funding requirements, the truth is that the Mexican market did not provide it. You were obliged to go to the dollar market, to the euro market, which were the deep markets. Now, with the three issuances, the Mexican market provided it. We have to look inward, cultivate this market, cultivate its investors and work on what the market needs, which is liquidity.

What will be your priorities for the new year?

What has been the most difficult is to understand what is going to happen with interest rates. Everybody is reviewing their guidance for the year. That has made it very difficult, deciding whether to go to the market today, whether to wait. What any CFO has to do is, number one, have the company’s refinancing risk covered. Number two, as far as possible, not to have too much exposure to currencies or interest rates. And we are doing well in that regard. We have a fairly balanced currency position and most of the debt is in fixed rates.

Quotable

“I suspect the back-slapping and ego-stroking won’t last four years. The questions will be: Where does Big Business draw its red lines, and how will it respond when Trump inevitably crosses them.”Beth Kowitt

Bloomberg Opinion columnistKowitt on the relationship between executives and Trump.

On the Bloomberg terminal

{BI PRODG <GO>} leads you to Bloomberg Intelligence’s independent research, including outlooks, primers and focus ideas for 2025. To learn more, click here to request a demo.

Revolving door

Isaac Mah, most recently CFO of Singapore Post’s Australia business, is taking over as group finance chief after the company fired a number of senior executives over allegations of misconduct. Singapore Post said its search for a new CEO continues.

Ricardo Bottas Dourado is joining Latam Airlines as its new CFO, succeeding former CFO Ramiro Alfonsin, who became the airline’s chief commercial officer in November. Bottas Dourado joins Latam after a stint as CEO of UnitedHealth Group in Brazil and an eight-year tenure at SulAmérica, a Brazilian insurer.

Fastenal CFO Holden Lewis has resigned from his role, effective April 16. Lewis, who became finance chief in 2016, isn’t departing due to any disagreement with the company, Fastenal said.

More from Bloomberg

- Money Stuff: Matt Levine’s daily newsletter on Wall Street and finance

- Odd Lots: Joe Weisenthal and Tracy Alloway track big macro trends

- Deals: Transactions and analysis, from IPOs to startup investing

- The Everything Risk connects the dots on the biggest economic issues

- The Brink: Corporate distress, bankruptcies and turnaround stories

- Explore all Bloomberg newsletters at Bloomberg.com.

Nina Trentmann is a senior editor at Bloomberg. Follow her on LinkedIn and write to her at ntrentmannma@bloomberg.net.Follow Us

Like getting this newsletter? There’s more where that came from. Browse all our weekly and daily emails to get even more insights from your Bloomberg.comsubscription.

Want to sponsor this newsletter? Get in touch here.You received this message because you are subscribed to Bloomberg’s CFO Briefing newsletter. If a friend forwarded you this message, sign up here to get it in your inbox.Unsubscribe

Bloomberg.com

Contact UsBloomberg L.P.

731 Lexington Avenue,

New York, NY 10022

One thought on “CFO Briefing 2025 Bloomberg”

Comments are closed.