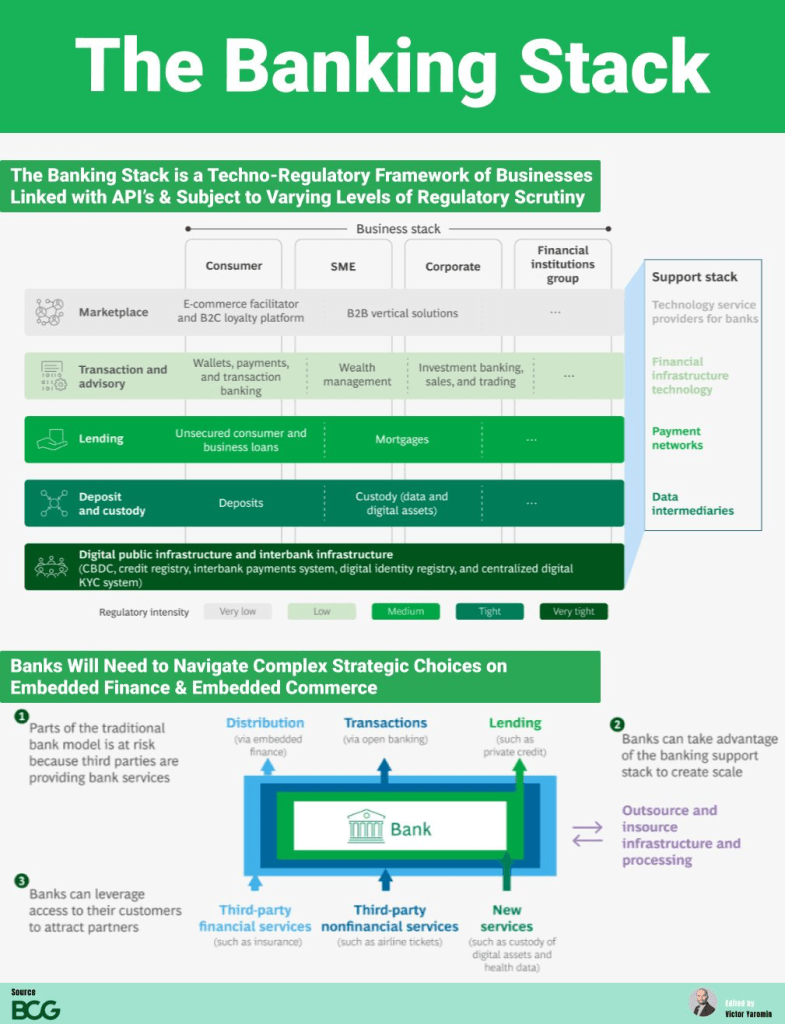

BCG The Banking Stack: A Techno-Regulatory Framework for the Future of Finance

The financial landscape is rapidly evolving, with banks transforming into platforms offering services and integrating third-party solutions. This image of “The Banking Stack” highlights how financial institutions can leverage hashtag#APIs, digital public infrastructure, and interbank systems like

hashtag#CBDCs to deliver seamless services to consumers, hashtag#SMEs, and corporates.

Key Takeaways:

1. Embedded hashtag#finance and third-party services are disrupting parts of the traditional hashtag#bank model.

2. Banks can scale by outsourcing and insourcing key processes while leveraging financial infrastructure technology.

3. Strategic partnerships can help banks offer new services like digital asset custody, health data, and more.

Future Vision:

Imagine a world where hashtag#financial services are as effortless as streaming music. From digital wallets to seamless mortgage approvals, the future will be powered by hashtag#openbanking, decentralized hashtag#identity systems, and real-time payment networks.

Thank you hashtag#BostonConsultingGroup (BCG)

Resource: https://lnkd.in/gsBfRQ2B

hashtag#banking hashtag#fintech hashtag#embeddedfinance hashtag#digitaltransformation

hashtag#futureoffinance hashtag#BCG