The Global Financial Stability Report is issued usually annually.

This issue has the sub text:

Safeguarding Financial Stability amid High Inflation and Geopolitical Risk

It is a long report and available at IMF. Here is the FT view.

The IMF has warned of a “hard landing” for the global economy if persistently troublesome inflation keeps interest rates higher for longer and amplifies financial risks.

On to the report.

The beginning of IMF Executive Summary is reproduced here. It summarises at a high level although it leaves out some important aspects in particular the financial mismanagement of the failed banks; a topic I covered earlier.

IMF GFSR – Executive Summary:

> A Financial System Tested by Higher Inflation and Interest Rates

Financial stability risks have risen significantly as the resilience of the global financial system has faced a number of severe tests since the October 2022 Global Financial Stability Report. In the aftermath of the global financial crisis, amid extremely low interest rates, compressed volatility, and ample liquidity, market participants increased their exposures to liquidity, duration, and credit risk, often employing financial leverage to boost returns— vulnerabilities repeatedly flagged in previous issues of the Global Financial Stability Report.

The sudden failures of Silicon Valley Bank and Signature Bank in the United States, and the loss of market confidence

in Credit Suisse, a global systemically important bank (GSIB) in Europe, have been a powerful reminder of the challenges posed by the interaction between tighter monetary and financial conditions and the buildup in vulnerabilities. Amplified by new technologies and the rapid spread of information through social media, what initially appeared to be isolated events in the US banking sector quickly spread to banks and financial markets across the world, causing a sell-off of risk assets (Figure ES.1). It also led to a significant repricing of monetary policy rate expec- tations, with magnitude and scale comparable to that of Black Monday in 1987 (Figure ES.2).

The forceful response by policymakers to stem systemic risks reduced market anxiety. In the United States, bank regulators took steps to guarantee uninsured deposits at the two failed institutions and to provide liquidity through a new Bank Term Funding Program to prevent further bank runs. In Switzerland, the Swiss National Bank provided emergency liquidity support to Credit Suisse, which was then taken over by UBS in a state- supported acquisition. But market sentiment remains fragile, and strains are still evident across a number of institutions and markets, as investors reassess the fundamental health of the financial system.

The fundamental question confronting market participants and policymakers is whether these recent events are a harbinger of more systemic stress that will test the resilience of the global finan- cial system—a canary in the coal mine—or simply the isolated manifestation of challenges from tighter monetary and financial conditions after more than a decade of ample liquidity. While there is little doubt that the regulatory changes implemented since the global financial crisis, especially at the largest banks, have made the financial system generally more resilient, concerns remain about vulnerabilities that may be hidden, not just at banks but also at nonbank financial intermediaries (NBFIs).

Ed Colin – except the moral hazard risk associated with Givernment actions guaranteeing all deposits will undoubtedly bring unintended new risks.

P85 of the IMF GFSR:

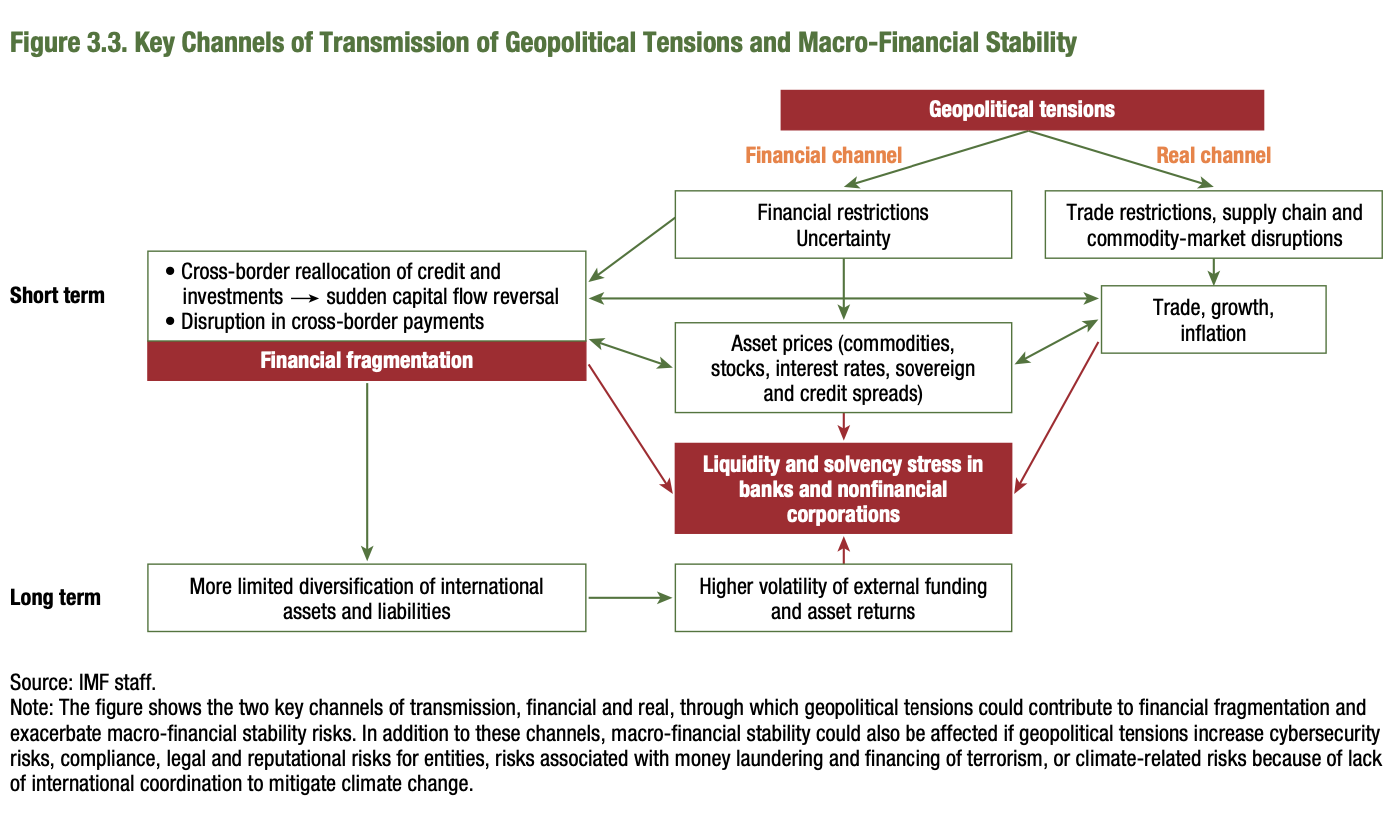

How Geopolitical Tensions Can Affect Financial Stability: A Conceptual Framework

Geopolitical tensions could lead to financial instability through two key channels. The first is directly through a financial channel triggered by restrictions placed on capital flows and payments (such as capital controls, financial sanctions, and international asset freezing) or through an increase in uncertainty and investors’ risk aversion to future restrictions, the escalation of conflict, or expro- priations (Figure 3.3). These factors could affect cross-border capital allocation and lead to finan- cial fragmentation, as well as to a decline in asset prices, as investors and lenders may adjust portfolio investment allocations and cut cross-border credit lines to the rival country (or group of countries).11 If capital is suddenly reallocated, it could gener-

ate liquidity and solvency stress in the financial and nonfinancial sectors by increasing funding costs or debt rollover risk and by reducing asset values and overall profitability, thereby threatening macro-financial stability.12,13

That’s all for now.