The IMF have released their working papers following their analysis of Canadian Banks. Notwithstanding the positive comments about Canadian banks financial position entering the crisis, there remains potential for a requirement for increased capital as negatives in Canada could decrease bank capital by 2.5% – 3.5% over next year or two.

The IMF employed the American stress test approach to Canadian banks in this exercise.

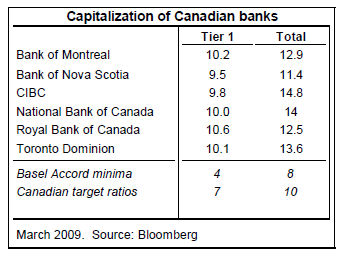

Here is the current position:

There are two ratios being watched – Tier 1 and Total Capital. In a nutshell and worst case scenario, IMF are saying if 2.5% or 3.5% is taken off either ratio, most banks risk being below the Canadian targets shown at the foot.

The potential negatives on bank capital were recognised as:

- Western Canada house values having some more downward corrections anticipated. Eastern Canada is about right in their view.

- collapse of auto sector

- variances in commodity prices

- continued high unemployment

The external influences on Canada are summarise in this graphical story line. Here is the full paper. Canada: 2009 Article IV Consultation—Staff Report cr09162